Audio By Carbonatix

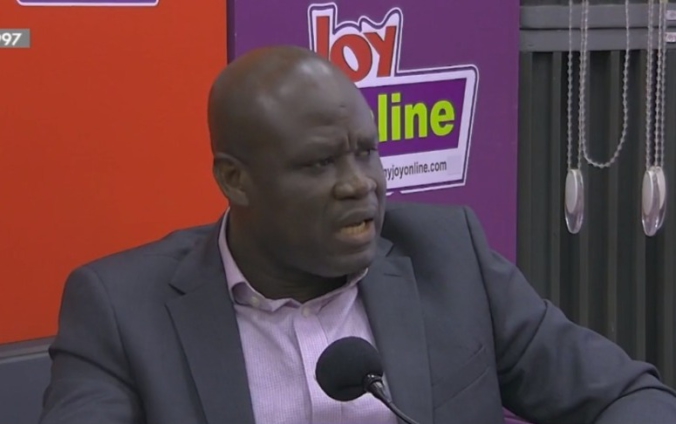

The Ghana National Chamber of Commerce and Industry (GNCCI) CEO, Mark Badu-Aboagye, has criticised Ghana’s banking sector for an unhealthy preference for short-term loans.

He argues that this trend undermines business expansion and industrial growth.

Speaking on Joy News’ PM Express Business Edition on Thursday, Mr Badu-Aboagye said Ghana’s real challenge is not necessarily access to credit in general, but access to the kind of credit businesses need to grow.

“So when we say access to credit, let’s look at it from the short term and the long term,” he said.

According to him, Ghanaian banks are comfortable offering short-term credit facilities, typically between three months and one year.

“So our banks, they like giving short-term credits. So usually it’s between three, six months and one year,” he stated.

He explained that short-term lending has not been the biggest headache for the private sector, because banks are willing to provide such loans and recover their money quickly.

“We wouldn’t have a challenge,” he said, adding that “as for the short ones like three months, because they also make their money, they will give it to you, and then later you come and pay.”

However, the GNCCI CEO stressed that the bigger problem lies in long-term credit, which he described as the real lifeline for businesses seeking to invest, expand, and create jobs.

“But for long-term credits, that is where we have had a challenge as a country, and that is what the businesses need,” he said.

Mr Badu-Aboagye used manufacturing as a key example, warning that Ghana cannot talk about industrialisation while financing remains largely short-term.

“In fact, if you want to set up a manufacturing company and they give you a one-year loan, you cannot even import your machines or prepare your machines, do a test, run before you start repaying,” he explained.

He argued that a one-year facility does not match the realities of establishing production, installing equipment, and completing test runs before full operations begin.

He also criticised the absence of moratorium periods that would allow businesses time to stabilise before repayment begins.

“They will not give you a moratorium for you to pay,” he said.

Mr Badu-Aboagye maintained that the lack of long-term financing continues to hold back businesses, especially those that require heavy investment before returns can be realised.

“So what we are saying is that the difficulty is long-term,” he noted.

He said the issue has persisted for years and continues to affect the growth trajectory of many businesses.

“But for the long-term credit, it has been a challenge all this time,” he said.

The GNCCI CEO’s comments come amid ongoing calls for reforms in Ghana’s credit system, as businesses struggle with high borrowing costs, tight repayment timelines and limited patient capital for expansion.

Mr Badu-Aboagye insists the conversation must move beyond simply saying businesses need credit and focus on the quality, structure and duration of lending.

“So the clarity is for the long term,” he said, arguing that long-term credit is what will allow businesses to invest properly, expand sustainably and contribute meaningfully to national development.

Latest Stories

-

A new chapter begins: MotoGP roars into 2026

2 hours -

Netflix declines to raise offer for Warner Bros

2 hours -

Chamber of chaos: Chicago braces for a WrestleMania-defining night

2 hours -

Russia and Ukraine exchange more than 1,000 soldiers’ bodies

2 hours -

First writing may be 40,000 years earlier than thought

3 hours -

Daniel Etim Effiong says rustication from school led him to acting breakthrough

3 hours -

Real Madrid condemn fan for alleged Nazi salute

3 hours -

Ronaldo becomes co-owner of Spanish side Almeria

3 hours -

Fans of richest English Premier League clubs pay £74 per match as ticket revenue soars

3 hours -

Palace see off Zrinjski to reach Conference League last 16

3 hours -

NAIMOS soldier shot during Dormaa anti-galamsey operation fully recovers

3 hours -

NAIMOS soldier shot in Dormaa Central recovers after anti-galamsey operation injury

3 hours -

Ghana isn’t legalising weed, we’re creating a therapeutic cannabis sector – Interior Minister

4 hours -

Lupita Nyong’o admits fear as fibroids return, urges better treatment options

4 hours -

Recreational use of cannabis remains illegal – Interior Minister warns

4 hours