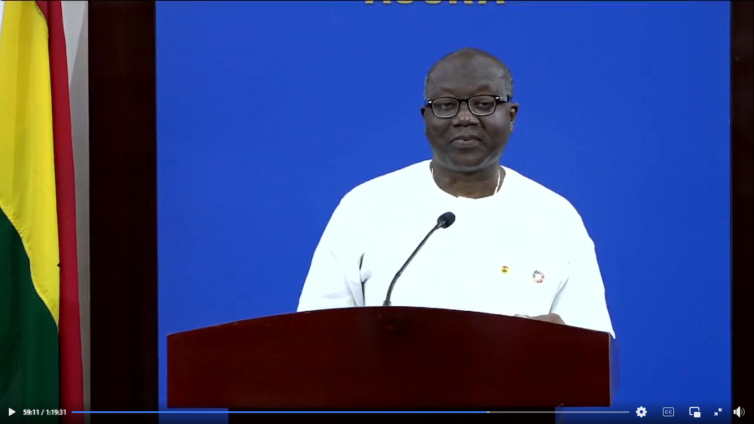

Finance Minister, Ken Ofori-Atta, has reiterated government’s commitment of not seeking assistance from the International Monetary Fund (IMF), to relief its debt.

According to him, the economy is heading in the right direction, and therefore government will find alternative ways of refinancing the country’s debt.

Disclosing this when he announced government’s support and programmes for the upcoming 2022 Annual Meetings of the African Development Bank, here in Accra this month, Mr. Ofori-Atta said government is intervening with policies to strengthen the economy.

“We have committed not to going back to the Fund because in terms of interventions of policy, we are right there and the Fund knows that we are completely in the right direction. And so the issue is validating the programme that we are putting in place and then in my view supporting us to find an alternative ways to refinance or reprofiling our debt without needing to be with the Fund.”

“I think is a general acknowledgement that should be the first point of call and we are doing it”, he stressed.

Mr. Ofori-Atta in March 2022 announced sweeping spending cuts to reduce the fiscal deficit, contain rising inflation and slow the cedi's slide, with the country facing a looming debt crisis.

This is coming on the back of rising inflation, the relatively weak cedi and downgrade of the country’s credit worthiness by rating agencies.

On the issue of restructuring debt, the Finance Minister said the issue was a complicated one, especially the Eurobond and the private sector loans.

“The issue of restructuring debt is a very complicated issue especially with the private sector and the Eurobond etc. We need to decide among ourselves on what type of structure that will be useful to us. We have essentially about 50/50 with regards to domestic and external debt.”

“The domestic debt of course has interest rates of about three and half times what the foreign debt is. And then we look at the profile and clearly the foreign debt in terms of the impact really begins to hit in 2025 with regards to our Eurobonds etc.”

To him, solving the domestic debt conundrum should be tackled immediately.

“So solving the domestic debt conundrum is what we should be looking at and that is where we are putting our minds as to how best to do that”.

On the rising inflation Mr. Ofori-Atta pointed out that though the situation is a global one, government is committed to building an entrepreneurial society to trade among themselves and reduce imported inflation.

Latest Stories

-

Paris 2024: LeBron James, Steph Curry and Kevin Durant named on USA basketball team

15 mins -

Woman rejected after a job interview because she wasn’t wearing makeup

18 mins -

4 little habits that cause big problems in your marriage

18 mins -

Election 2024: NPP establishes PWDs secretariat; targets 1.6 million PWDs votes

19 mins -

PIAC touts GNPC’s prowess as key energy provider

25 mins -

Fidelity Bank joins United Nations Global Compact initiative

27 mins -

Let’s leverage digital age to empower female CEOs, entrepreneurs – Bawumia

36 mins -

MTN and Huawei launch Joint Technology Innovation Lab to drive Africa’s digital transformation

46 mins -

‘I have no regrets’ – Pep Guardiola on Man City’s Champions League exit

53 mins -

Ghana, Vietnam commit to promoting bilateral relations

53 mins -

Police officer dies in pursuit of traffic offender

58 mins -

NDC’s attempt to pooh-pooh our efforts to increase Ghana’s power grid senseless – Atta Akyea

59 mins -

Paris 2024: Cadman Yamoah eyes Olympics spot

2 hours -

Bayern Munich end Arsenal’s Champions League dream as Kimmich scores winner

2 hours -

Alan endorsed as ARC’s Presidential Candidate – Buaben Asamoa

2 hours