The show must go on… whether licenses are revoked or covid-19 is here to stay, we cannot stop. Ours is a market economy and the blood of any market economy is finance.

On August 16, 2019, the Bank of Ghana revoked the operating license of 23 Savings and Loans Companies and Finance Houses. Two and half months before that, 347 microfinance companies had been shut down.

Small and medium-sized enterprises (SMEs) are the backbone of the Ghanaian economy – they represent about 85% of businesses, largely within the private sector, and contribute about 70% of Ghana's gross domestic product (GDP).

In terms of formal sector employment, they account for just over half of all fulltime employment. This percentage is thought to be much higher in the informal sector.

Until the recent revocation of licenses and shutdowns, a growing finance sector had supported a sustained growth of SMEs. There are many stories of ‘table-top’ businesses, moving from one employee to full-fledged businesses that employ more than 50 people A strong finance sector is therefore good for the Ghanaian economy.

Where did we come from and how did we get here?

Non-Bank Finance Institutions (NBFI’s) have been in business since the early 90s. But the early successes of UT Financial Services, co-founded by Joseph Nsonamoah and Prince Kofi Amoabeng in 1997 as Unique Trust Financial Services accelerated the sector's growth.

Private capital, sensing an opportunity, ‘poured’ into the sector. Other institutions, for example, those licensed by the Securities and Exchange Commission also ‘stretched’ the scope of their license and joined the ‘party’.

Over time, look and feel became 'more' important than substance. Many people became 'wall street' bankers with Saville Row suits and monogrammed shirts.

Limousines, first-class travel to chase 'non-existent' deals, high salaries, and perks with luxurious offices became de rigueur. Meanwhile, most transactions were either directly or indirectly linked to the government, and others simply ‘fueled’ delusions of grandeur.

As the sector got crowded, the economy slowed down, the government was unable to pay its debts in full and/or on time, and transactions dried up, competition amongst financial institutions for business and deposits to refinance their exposures grew.

Firms took more and more risk and the cost of funds kept rising as the need to shore up ever-dwindling reserves rose. Some executives went rouge, concocting credit files, and coaching borrowers to steal from their employers and clients.

As if that was not bad enough, the recovery of loans was made torturous by systemic weaknesses. A crumbling land registration system, defunct address system, diversion of funds by SMEs, and a weak contract enforcement infrastructure contributed to a rise in loan defaults. The rest they say is history.

So what is the role of NBFI’s?

Commercial Banks tend to focus on government business, large corporates, and multinationals, for a variety of reasons. One of the main reasons they do this is their lack of confidence in the SME’s ability to manage their operations effectively to be able to repay the loans they access.

In some cases, this is a genuine concern. But the main reason is that banks can make money more easily. ‘Breathing’ down the neck of an irrepressible entrepreneur to ensure they repay their loans is too stressful in a suit and tie. In a high-interest rate environment, the incentive for Commercial Banks to fund SMEs is even much less.

It is easier for Commercial Banks to purchase government bonds or lend to the government indirectly through parastatals and watch their money grow. Government business is good business. The government will always pay and hardly complains!

Why the show must go on.

Despite the challenges, SMEs - ‘the engine of growth’ still require financing. Investment in the non-bank sector is dominated by Ghanaians and control of the financial sector by indigenous companies is a matter of National Security.

There are certain risks a foreign financial institution will never take. And lending to SMEs is a frisk that foreign financial institutions will never take. We put a great deal of premium on foreign financial institutions, forgetting that those institutions that we admire have been in business for over 200 years.

These institutions have survived many storms, battered and bruised, and have approached the shore, masts broken, sails torn and taking in water by the ship full.

As recently as 2007–2008, during the global financial crisis, some of them had to run for cover and have not recovered. But that is how institutions are built. It takes time, patience, and fortitude.

We must grow our financial institutions to support SMEs. One day, these institutions will be financing Ghanaian companies in cross-border transactions. The South African and Nigerian banks have done a great job of that in Ghana.

Payroll lending is great, but if all NBFI’s become payroll lenders, there would be no development. Who would finance our SMEs? What our NBFI’s require is tough love, not vilification.

A lot has been done and a lot more can be done to strengthen NBFI’s, the Bank of Ghana Corporate Governance Directives, calibrated over time, will strengthen corporate governance in the financial sector. Institutions must also work extra hard to get rid of the perception that they are run by rouges.

The judicial system must dispatch commercial cases expeditiously. The Bank of Ghana should introduce a Bank Verification Number (BVN) system as in Nigeria. The BVN is an 11-digit number that acts as your universal ID in all commercial banks in Nigeria.

The Central Bank of Nigeria implemented this biometric system which helps to prevent issues of identity theft, reduce fraud, enhances the banking industry’s chances of being able to fish out blacklisted customers, and encourages standardisation of banking operations across the sector.

These actions will increase investor confidence, attract funds to the financial sector to reduce the cost of operations and funds. Ultimately this will deliver the crown jewels, a reduction in the cost of loans.

If the cost of loans falls to less than 10% per annum, long term investments will become attractive, SMEs will flourish as they can afford to borrow for investment in their businesses, and the economy of Ghana will boom.

It is our financial system, and the more we work together to strengthen it, the better for all us. Strengthening our financial system is the only way to deliver prosperity for all Ghanaians. What is crystal clear is that “…the show must go on..!”

****

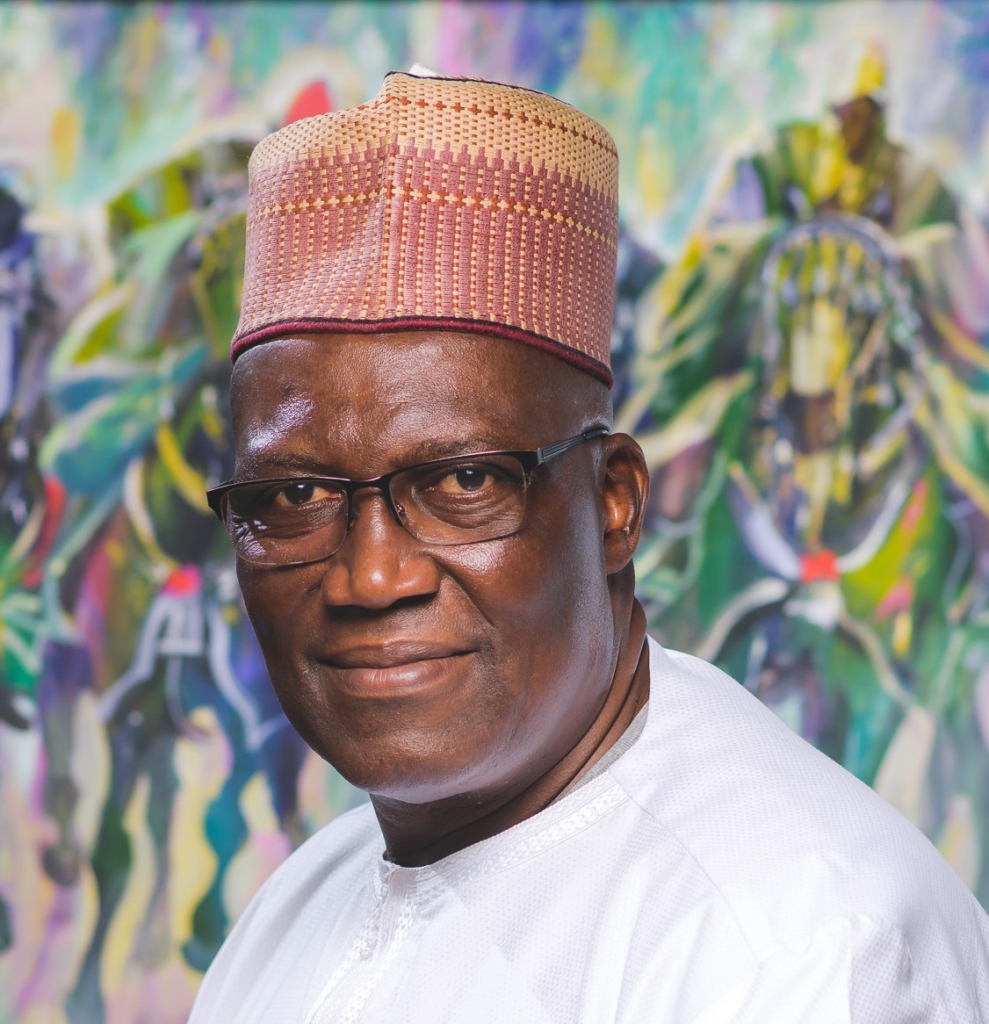

Kenneth Thompson is an orator and a Thought Leader on finance and economic matters. He is a Fellow of the Institute of Chartered Accountants in England and Wales and the CEO of Dalex Finance Limited, a specialised deposit-taking institution.

Latest Stories

-

Funny Face failed to perform at my show after taking money – Parrot Mouth

1 min -

CAFCC: Sports Minister to offer Dreams FC a ‘surprise’ package before Zamalek clash

13 mins -

CAF awards 3-0 win to RS Berkane, after Algerian customs confiscated their kits

27 mins -

AgriTech challenge pro holds first pitch

32 mins -

UNIDO commits to improving local rice standards

33 mins -

Suleja prison: 108 inmates on the run in Nigeria

36 mins -

We object to government’s plans to make BEST sole off-taker of Sentuo Oil Refinery – CBOD

44 mins -

Burkina Faso army massacred 223 villagers in revenge attack – HRW

53 mins -

Lebanese Community awards ¢100K in scholarships to 21 students at UniMAC

55 mins -

Germany detains alleged Nigerian mafia members

57 mins -

Manhyia Palace hosts royals, dignitaries from Ghana and beyond at special Awukudee

1 hour -

Meet the two Ghanaian entrepreneurs on a mission to connect 1 million African professionals to global companies by 2034

1 hour -

Celestine Donkor speaks on report of undergoing weight loss surgery

1 hour -

Music sensation Osb Swagah drops new single ‘Victory’

1 hour -

Bright Simons: The SML defence “falls flat”

2 hours