Audio By Carbonatix

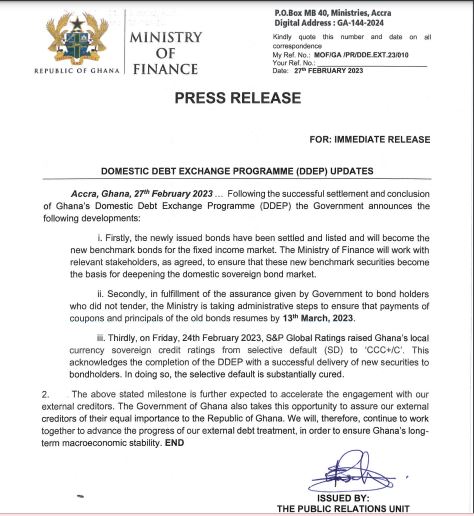

Finance Ministry says payment of coupons and principals in respect of the Domestic Debt Exchange Programme (DDEP) will start on March 13, 2023.

According to a release issued by the Ministry, this only applies to old bondholders who did not sign up for the DDEP.

“Secondly, in fulfillment of the assurance given by Government to bondholders who did not tender, the Ministry is taking administrative steps to ensure that payments of coupons and principals of the old bonds resume by 13th March, 2023,” part of the statement reads.

The assurance comes against the backdrop of three bondholder groups marching to the Finance Ministry on Monday to demand the immediate payment of coupons and principals which matured on February 6th and 20th February, 2023.

They are the Coalition of Individual Bondholders Groups made up of Pensioner Bondholders Forum, Individual Bondholders Association of Ghana and Individual Bondholders Forum.

The group gathered at the Finance Ministry on Monday, February 27, to check on the payment of coupons and principal for bondholders whose bonds had matured but whose payment had not been honoured despite government's promise.

Also, the Finance Minister, Ken Ofori-Atta promised that outstanding bonds which matured on February 6 for which government defaulted will be honoured after February 21.

“Settlements will be made after Tuesday, February 21 and then we can begin to look at processing everybody’s [bonds],” the Finance Minister assured the pensioner individual bondholders when they met to thank him for exempting them from the Debt Exchange Programme.

But in an interview with JoyNews’ Joseph Ackay Blay, the convener of the Pensioner Bondholders Forum, Dr. Adu Anane Antwi said the group wants to know what is causing the delay in payment.

According to him, the individual bondholders are worried.

“We are here to find out why coupons the Minister said will be paid on the 21st after the settlement day, we haven’t heard any information from the Ministry and therefore, we have come to find out why the payment has not been made yet,” he said.

Meanwhile, the release further noted that the newly issued bonds have been settled and listed and will become the new benchmark bonds for the fixed-income market.

The Ministry of Finance noted that it will work with “relevant stakeholders, as agreed, to ensure that these new benchmark securities become the basis for deepening the domestic sovereign bond market.”

Latest Stories

-

‘I will never forget you’ – Kennedy Agyapong thanks supporters, NPP delegates after primaries

2 hours -

Woman found dead in boyfriend’s room at Somanya

3 hours -

Woman feared dead after being swept away in Nima drain amid heavy rain

3 hours -

Court grants GH¢10k bail to trader who posed as soldier at 37 Military Hospital

4 hours -

Tano North MP secures funding to reconstruct decades-old Yamfo Market

4 hours -

Haruna Iddrisu discharged after road traffic accident

4 hours -

Kenyans drop flowers for Valentine’s bouquets of cash. Not everyone is impressed

4 hours -

Human trafficking and cyber fraud syndicate busted at Pokuase

4 hours -

Photos: First Lady attends African First Ladies for Development meeting in Ethiopia

5 hours -

2026 U20 WWCQ: Black Princesses beat South Africa to make final round

5 hours -

World Para Athletics: UAE Ambassador applauds Ghana for medal-winning feat

6 hours -

Photos: Ghana’s path to AU Chairmanship begins with Vice Chair election

6 hours -

Chinese business leader Xu Ningquan champions lawful investment and deeper Ghana–China trade ties

6 hours -

President Mahama elected AU First Vice Chair as Burundi takes over leadership

7 hours -

Police work to restore calm and clear road after fatal tanker crash on Suhum–Nsawam Highway

7 hours