The policy rate- the rate at which commercial banks borrow from the Bank of Ghana- will remain unchanged at 14.5%, at least until after the first quarter of next year, Fitch Solutions has disclosed.

This means cost of borrowing will stay largely same during the period.

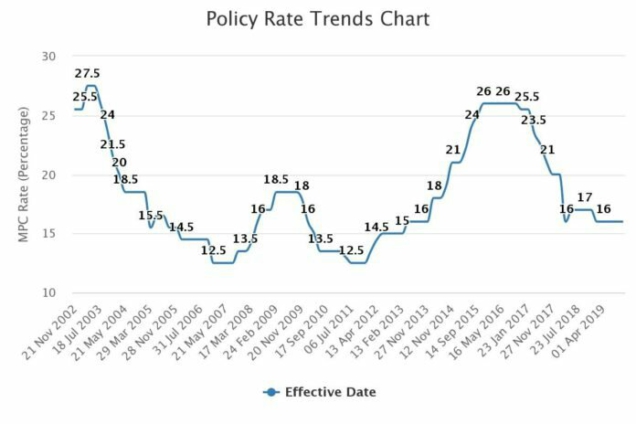

The Bank of Ghana cut its base lending rate by 1.5 percentage points to 14.5% in March 2020, the first time in 14 months. The move was to stimulate spending in the Ghanaian economy and increase money supply.

Senior Country Risk Analyst for Sub Saharan Africa, William Attwell told Joy Business that there will be some monetary policy easing getting to mid-next year when economic growth picks up.

“Interest rate decisions in Ghana could come, that’s of course, till then the Bank of Ghana will hold rate [policy rate] steady. The most recent inflation is still outside of the Central Bank’s target so we would expect that ratings will hold for some time being”

Furthermore, he said “looking ahead to next year though as the Central Bank is likely to encourage recovery to gather pace next year, we would expect a bit of monetary policy easing during mid-2021,” he said.

September 2020 MPC Report

The Bank of Ghana cited risks to inflation and growth as the reason to keeping its base lending rate unchanged in September 2020.

“The Committee’s view is that risks to the immediate outlook for inflation and growth are broadly balanced and decided to keep the policy rate unchanged at 14.5%”, it said in a statement.

It however emphasized that he drivers of economic growth are returning to normal with prospects for a good recovery, adding, monetary and fiscal policies have been supportive, providing the necessary underpinnings for the economy to withstand the negative output shock arising from the covid-19 pandemic.

Interest rate development

Interest rates on the money market saw mixed developments as rates on short to medium term instruments eased between Quarter Two and Quarter Three, but generally tightened at the longer-end.

On a year-on-year basis, the 91-day Treasury bill rate declined to about 14.0% in August 2020 from 14.7% a year ago.

Similarly, the interest rate on the 182-day instrument declined to 14.1% from 15.2%.

With the exception of the 6-year bond, yields on the 7-year, 10-year, 15-year, and 20-year bonds all increased.

Presently, treasury yields are hovering around 14.5%

Latest Stories

-

Saglemi Housing Project: Government promises transparency in divestiture

13 mins -

I don’t want to deceive myself as a politician – Alan Kyerematen

21 mins -

We will continue to provide more financing for Ghana despite not reaching agreement with Eurobond holders – IMF

34 mins -

Economic outlook for Sub-Saharan Africa including Ghana gradually improving – IMF

1 hour -

Ghana’s inflation to average 11.5% in 2025; policy rate expected to reduce sharply – IMF

1 hour -

Let’s prioritize research quality in higher education institutions for industrial growth-Prof. Nathaniel Boso

9 hours -

Herman Suede is set to release ‘How Dare You’ on April 24

12 hours -

Heal KATH: Kuapa Kokoo, Association of Garages donate 120k to support project

13 hours -

KNUST signs MOU with Valco Trust Fund, Bekwai Municipal Hospital to build student hostel

13 hours -

The influence Ronaldo has on people, Cadman Yamoah will have same on the next generation – Coach Goodwin

13 hours -

Gender Advocate Emelia Naa Ayeley Aryee Wins prestigious Merck Foundation Awards

14 hours -

South Africa bursary scandal suspects granted bail

15 hours -

Ecobank successfully repays $500m Eurobond due April 18

15 hours -

Re: Doe Adjaho, Torgbui Samlafo IV, call for Unity among Paramountcies in Anlo

15 hours -

Extortion and kidnap – a deadly journey across Mexico into the US

15 hours