Background and objectives

In 2019, the National Insurance Commission (NIC) and the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, on behalf of the German Federal Ministry of Economic Cooperation and Development (BMZ), conducted research into the perception members of the general public hold about insurance as well as the level of insurance awareness they have. The research was also to measure the Confidence Index of Insurance in Ghana.

The study revealed that, the average attitude index as of 2019 was 55.15 out of 100; the average confidence index was 46.7 out of 100; whiles the knowledge index was 60.07% signifying that a lot needs to be done to enhance the various indices. Since the baseline assessment, the NIC has undertaken numerous interventions targeted at enhancing the public knowledge, attitude and confidence of insurance in Ghana. Some of these interventions include insurance awareness and education programmes across the seven NIC jurisdictional offices as well as carrying out agency training programmes.

As a recommendation from the baseline, the NIC undertook a yearly update of these indices, and to help measure the impact of its interventions. The phase 2 assignment was in line with management decision to implement the recommendations on the annual update of the indices. The specific objectives of the phase 2 research were to:

- Assess the general public perceptions and understanding of insurance concepts, products and companies;

- Assess the general public knowledge of insurance concepts, products and companies;

- Assess the attitude of the general public towards insurance concepts, products and companies;

- Assess general public experiences regarding raising queries, complaints and disputes resolutions;

- Identify issues that need to be addressed to improve public confidence; and

- Update the current Public Confidence Index in insurance with both national and regional perspectives

Sample Size and Geographical Spread

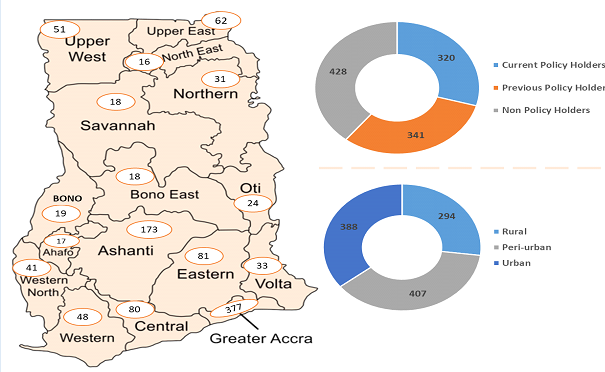

The research was conducted in all the 16 regions of Ghana, involving a total of 1,089 individual respondents. These individual respondents comprised 320 active policyholders, 341 previous policyholders, and 428 non-policyholders located in rural, peri-urban and urban localities, as presented in Figure 1. The phase 2 research used the same sample size and geographical spread as in the baseline research.

Sample Size and Geographical Spread

The research was conducted in all the 16 regions of Ghana involving a total of 1,089 individual respondents.

These individual respondents comprised 320 active policyholders, 341 previous policyholders, and four hundred and twenty-eight (428) non-policyholders located in rural, peri-urban and urban localities as presented in Figure 1.

The phase 2 research used the same sample size and geographical spread as in the baseline research.

Conclusions

The following conclusions were drawn on the objectives of the phase 2 research

That the 2020 general public perception and attitude towards insurance concepts, products and companies stand at 57.04 out of 100; a two-percentage point above the 2019 index of 55.15.

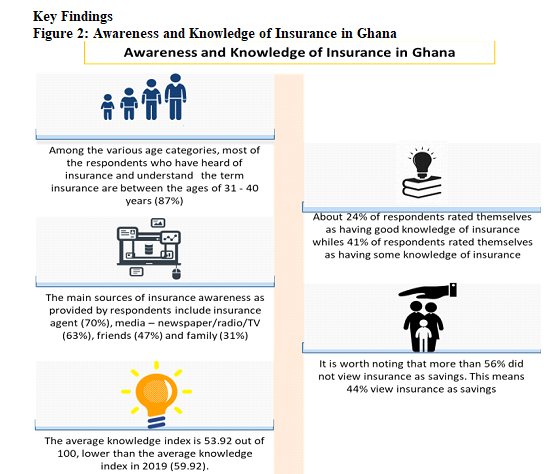

That in spite of the public awareness campaigns undertaken by NIC since 2019, the general public knowledge of insurance concepts, products and companies index declined from 59.92 to 53.92 in 2020 possibly due to the COVID-19 pandemic.

The research generated an average confidence index of 56.66 for 2020, which is ten percentage points higher than the 2019 index of 46.6. Similar to the baseline in 2019, the important performance matrix identified issues such as relationship, loyalty, claims, trust and protection to be given much attention in order to drive the confidence of insurance among Ghanaians.

The full report can be accessed on the NIC website: www.nicgh.org

Latest Stories

-

Oil prices projected to average $84 in 2024 – World Bank

10 mins -

Meet 2 Ghanaian entrepreneurs on a mission to connect 1m African professionals to global companies by 2034

41 mins -

NCA approves Starlink’s satellite broadband application

41 mins -

Government orders FGR to revamp mining operations; assures workers of commitment to their welfare

47 mins -

Arne Slot philosophy could suit Liverpool – Van Dijk

57 mins -

EC replies Mahama: You also appointed someone who was tagged NDC

1 hour -

See colourful outdoor of Prof Naana Opoku-Agyemang as NDC’s running mate

2 hours -

Akufo-Addo commissions 15MWP Kaleo Solar Power Plant

2 hours -

GCB Bank PLC leads African financial integration, hosts ZICB delegation

2 hours -

Empowering Girls in ICT: FAWE Ghana advocates for gender equality in the Tech sector

3 hours -

Rangnick ‘contacted by Bayern Munich’ about manager job

3 hours -

Winneba Youth Choir celebrates 35th Anniversary with Aseda Concert sponsored by Fidelity Bank

3 hours -

Bonwire residents reject Agya Koo’s endorsement of Ejisu NPP MP aspirant

3 hours -

SSNIT to run out of reserves due to deficits – ILO

3 hours -

Lagos officials eye Jospong Group’s eco-friendly waste management module

4 hours