Audio By Carbonatix

Ghana’s cocoa export earnings have seen a dramatic jump in 2025, and everyone is asking the same question: what’s behind the surge?

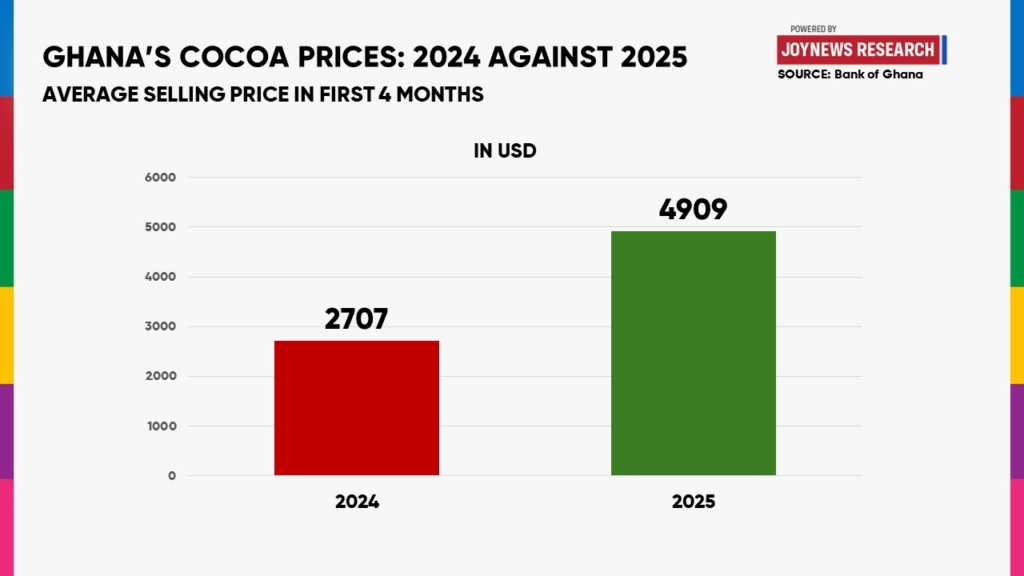

According to Bank of Ghana data, cocoa export revenues for the first four months of 2025 reached $1.84 billion, more than triple the $579 million recorded during the same period in 2024. Remarkably, this four-month total exceeds Ghana’s cocoa earnings for the first eleven months of 2024.

But how did this happen?

What’s Fueling the Surge?

There’s no single explanation, but analysts are pointing to several key factors:

Decline in smuggling: Improved farmgate prices have made it economically unwise for farmers to smuggle cocoa through unofficial routes, increasing the volumes flowing through official export channels.

Clampdown on illegal mining: The current administration's efforts to curb illegal mining (galamsey) have helped preserve cocoa farms, boosting potential production.

According to experts, this rise was already projected. The Ghana COCOBOD forecasts cocoa production for the 2024/2025 market year (October–September) at 700,000 metric tons (MT), a 32% increase over the previous year’s estimate of 531,000 MT.

Still, while all these may be contributing, it's difficult to make a solid case based on production alone, since no official production data for 2025 has been released yet.

What Do We Know?

There are two key markets in the cocoa trade:

Spot market: Cocoa is sold for immediate delivery and payment at current global prices.

Futures market: Cocoa is sold for delivery at a future date at a pre-agreed price, typically based on the average prices from the previous year.

Ghana has traditionally traded through the futures market, meaning beans sold this year were priced based on last year’s average. This system provides stability; if prices fall, Ghana benefits from earlier, higher prices. But if prices rise, Ghana misses out on those gains.

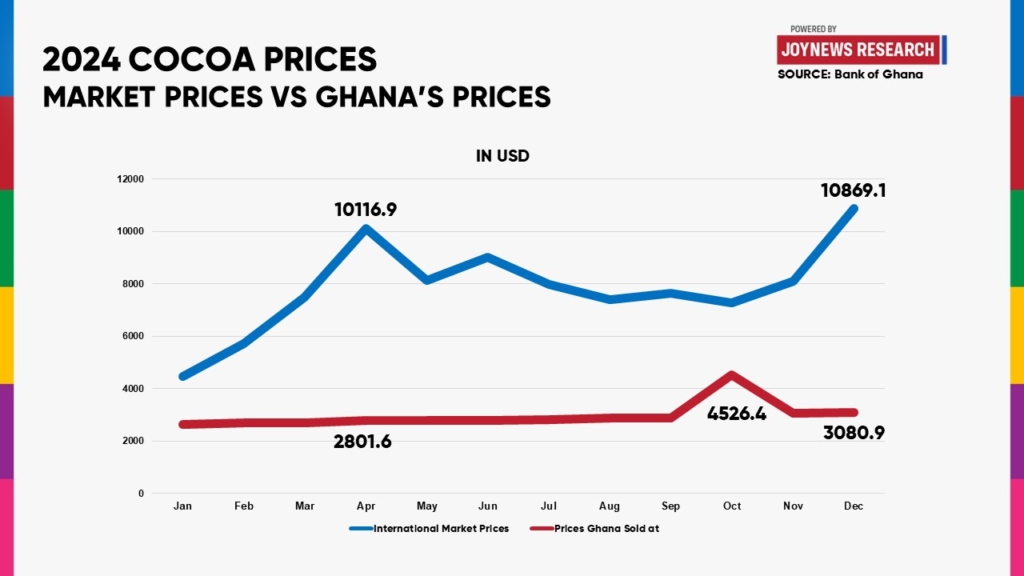

That is what happened in 2024: cocoa prices surged globally, but Ghana had already sold its beans using 2023’s lower prices. As a result, the country did not benefit from the price boom, hence the low earnings that year, despite high international prices.

What’s Different in 2025?

This year, Ghana stands to benefit, no matter which market it is operating in:

- If selling through the futures market, last year’s high global prices would have influenced higher contract prices, boosting this year’s export earnings.

- If using the spot market, the current market prices remain high, which also increases revenue.

From both scenarios, Ghana wins.

There are strong indications that Ghana may have shifted away from the futures market and become more active in the spot market this year. Why? Ghana was unable to secure its usual syndicated loans for cocoa purchases this season. These loans typically finance the forward buying of cocoa, which underpins the futures system.

Due to uncertainties in production capacity, driven by illegal mining and smuggling risks, lenders pulled back. As a result, Ghana has relied more on the spot market, where prices are high and payment is faster.

JoyNews checks indicate that Ghana is now very active in spot market sales.

Latest Stories

-

“I am strengthened by Psalm 118 vs 22” – Bawumia highlights cornerstone verse

2 minutes -

Ledzokuku South Circuit triumphs in maiden Ga language competition as officials push cultural revival

6 minutes -

Government deepens private sector partnerships to tackle housing deficit

7 minutes -

T-bills auction: Government records 253% oversubscription; interest rates fall to 8.6%.

18 minutes -

AGI pushes for cocoa processing plants in growing areas to boost value addition

18 minutes -

Luv FM and The Crush Bar create great Vals Day vibes for couples

20 minutes -

A/R: Three schools support KATH Blood Bank in MTN-sponsored donation drive

23 minutes -

Over 1,600 parcels of suspected narcotics intercepted in three separate operations

28 minutes -

Ghana to become Africa’s 8th biggest economy in 2026

33 minutes -

Bawumia urges NPP members forgive eachother and move past campaign disagreements

37 minutes -

Teacher Trainees’ Association welcomes suspension of CETAG strike, calls for renewed commitment

46 minutes -

Motorbike raids on villages kill dozens in Nigeria

53 minutes -

UK wants action taken on Russia after Navalny frog poisoning, Cooper says

53 minutes -

Ukraine’s ex-energy minister detained while attempting to leave country

53 minutes -

Bekwai MP opposes creation of 24-Hour Economy Secretariat; advises Gov’t to use the money to pay cocoa farmers instead.

55 minutes