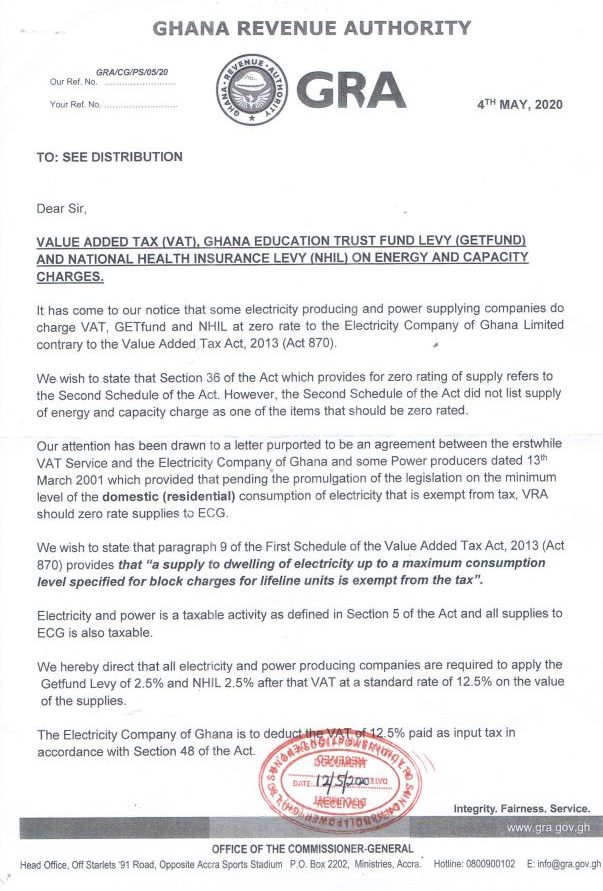

The Ghana Revenue Authority (GRA) has directed all electricity and power-producing companies in the country to apply the Getfund Levy of 2.5%, National Health Insurance Levy (NHIL) of 2.5% and Value Added Tax (VAT) at a standard rate of 12.5% on the value of power supplies to the Electricity Company of Ghana (ECG).

According to the Authority, their attention was drawn to a letter purported to be an agreement between the erstwhile VAT Service and ECG and some power producers which stated that the VRA should zero rate supplies to ECG.

This, the GRA, said is in contravention to the Value Added Tax, 2013 (Act 870) which does not list supply of energy and capacity charge as one of the items that should be zero-rated.

“We wish to state that Section 36 of the Act which provides for zero-rating of supply refers to the Second Schedule of the Act. However, the Second Schedule of the Act did not list supply of energy and capacity charge as one of the items that should be zero-rated,” GRA said.

In a statement signed by its Acting Commissioner-General, Ammishadai Owusu-Amoah, the GRA made clear that “electricity and power is a taxable activity as defined in section 5 of the Act and all supplies to ECG is also taxable.”

They are, therefore, directing all electricity and power producers to start charging ECG the prescribed levies under the law.

Latest Stories

-

Kenyan military chief among 10 people killed in helicopter crash

45 seconds -

Insinuating Bagbin is not heeding calls for recall because he is NDC unfounded and unfortunate – Parliament

2 hours -

Ashanti, Nelly are engaged and expecting a baby

2 hours -

New Ghana train on test run involved in accident

3 hours -

World Bank, AfDB partner to provide 300m African’s with electricity access

3 hours -

Ghana wins preliminary ruling in Cassius Mining’s $300m international arbitration

3 hours -

Ghana’s revenue-to-GDP ratio to exceed 17% within next six years, but expenditure to remain flat – IMF

3 hours -

Gborbu Wulomo didn’t marry Naa Okromo – Chieftaincy Minister

3 hours -

Oquaye Jr. says he’s undeterred by ‘propaganda’ twist to viral laundry video

3 hours -

Ghana’s debt-to-GDP ratio to tumble to 69.7% in 2029 – IMF

4 hours -

Interior Ministry imposes 4pm to 7am curfew on Sampa

4 hours -

Child marriage: Teenage girl to be released to her family – Gender Minister-designate

4 hours -

Naa Okromo is 15 years old, still a virgin and not married to Gborbu Wulomo – Government

4 hours -

GhIE condemns intervention by Ashanti Regional Minister in ECG Affairs; commends ECG GM for upholding regulatory standards

4 hours -

GPL: Asantehene tasks Asante Kotoko to do ‘better’ after crucial meeting

4 hours