In mid-May 2023 the International Monetary Fund (IMF) finally approved a US$3 billion 36-month arrangement with Ghana. It immediately disbursed the first tranche of US$600 million.

This is the second time in the past eight years that the country has approached the IMF. And it’s the 17th time since independence in 1957 – that’s roughly once every four years on average.

The first tranche of the latest loan is expected to be used to bolster Ghana’s foreign currency reserves and help stabilise the cedi as well as for budget support, according to the finance ministry.

Ghana has been facing severe economic and financial challenges since early 2022. This has included defaulting on some of its domestic and international debt. In December 2022, Ghana declared a moratorium on its international debt and further technically defaulted in February 2023 after failing to pay a coupon - the interest rate paid on a bond - on one of its debts following the expiration of a grace period.

The country’s unsustainable debt levels forced the government to go back to the IMF for another bailout in July 2022.

As an economist and risk analyst who has written about and researched Ghana’s economy and its IMF engagements, my view is that – despite the IMF deal – Ghana isn’t out of trouble yet.

Getting further tranches of IMF funding is dependent on Ghana showing progress on a range of eight IMF programme objectives and policies. For ease of analysis, I have put these under three themes: external debt arrangements; socioeconomic reforms – austerity and necessary trade-offs; and central bank reforms.

Debt restructuring under the G20 Common Framework

Ghana will find it difficult to achieve substantial savings on external debt restructuring.

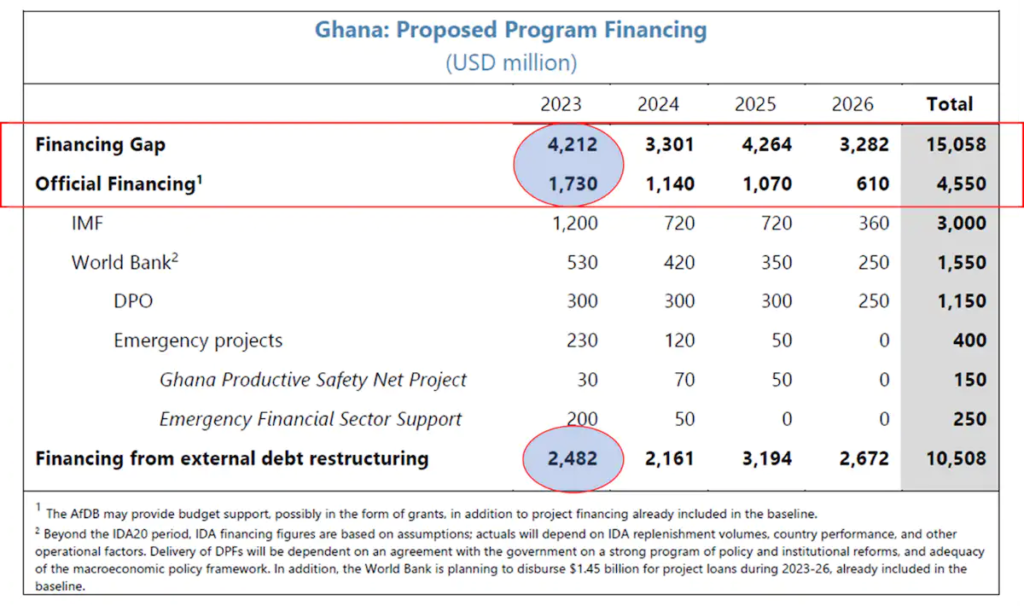

The IMF estimates that Ghana faces a total financing gap of US$15.06 billion between 2023-26. Of this, US$4.5 billion (30%) is expected to be received through official financing from the IMF and World Bank. Another US$10.51 billion (70%) is expected as financing from savings gained from restructuring its external debt arrangements.

This means that Ghana must secure an average of US$2.6 billion yearly in external debt-service payments relief during the programme implementation from 2023 to 2026. It will have to do so under the G20 Common Framework which was established by the world’s 20 largest economies in 2020. It is one of the main multilateral mechanisms for forgiving and restructuring sovereign debt.

But reaching deals with countries under the framework has proved to be difficult because of major disagreements between traditional Paris Club creditors such as France, Germany, Japan and Israel on one side and China on the other. China is an ad hocmember of the club. The biggest bone of contention is whether multilateral debt owed to the IMF, World Bank and others should be included in any sovereign debt restructuring exercise.

Multilaterals contend that their debt has preferred creditor statusas they are often the lender of last resort to sovereigns. That is, its debt is senior to all other government or bilateral creditors, which are in turn senior to commercial bonds and loans owed to private creditors. Thus, their argument goes, these multilaterals mustn’t be included in any sovereign restructuring. China disagrees.

This has been a major stumbling block to achieving meaningful progress on official bilateral debt restructuring. For example, Zambia applied for support under the framework in 2021 and secured a 38-month extended credit facility in August 2022. But by May 2023 it still hadn’t reached a final deal with creditors due to the ongoing disagreements.

Ghana also faces difficult negotiations with private creditors. Most are hesitant to support debt relief efforts because they have obligations to their shareholders, some of which include global pension funds. In Ghana’s case, private creditors account for US$17 billion (76%) of the US$22 billion external debt up for restructuring.

Socio-economic reforms

The IMF programme also comes with conditionalities, including the need for reforms in tax policy, revenue administration, governance reforms and public financial management.

The new agreement includes specific initiatives on the revenue side. Among these is removal of value added tax (VAT) exemptions for companies, which is expected to save 2% of GDP; and phasing out of corporate income tax holidays and exemptions and aggressive profit shifting schemes used by companies to reduce their tax payments.

Others are automatically adjusting fuel prices and electricity tariffs for exchange rate and inflation, and adopting a new fiscal regime for the extractive industries. This is meant to increase government’s share of the revenues from the mining and oil and gas sectors by improving monitoring and cost auditing, among others.

Ghana’s latest IMF programme seeks to protect - and in some instances increase - social sector spending in the areas of education, health and social protection while addressing regional disparities in access and outcomes.

Domestic borrowing

The IMF estimates that the Bank of Ghana financed the government’s budget through overdrafts to the tune of 7.2% of gross domestic product (GDP) in 2022. This was in contravention of the country’s law, which sets a 5% threshold for this type of financing.

Central bank financing of fiscal deficits isn’t new. It became important following the 2008-09 global financial crisis and the COVID-19 pandemic due to increasing government debts and reduced tax revenues. The amount of central bank financing is often codified in law and subject to legislative approval in most countries.

To ensure discipline, the IMF has asked for the current law governing the central bank to be amended. This is to strengthen central bank independence and eliminate central bank financing of the budget deficit, which further drives inflation. The government would stop borrowing from the Bank of Ghana. There would be a clear definition of emergencies under which this limit could be temporarily lifted, and how it could be enforced.

Conclusion

Fixing Ghana’s external debt issues under the latest IMF programme would be highly challenging, given the recent experiences of Zambia and others under the G20 Common Framework. Ghana, like Zambia, may become a victim of the international geopolitics of debt, prolonging debt relief and making it even more vulnerable.

Also, while some governance reforms are proposed under the IMF programme, political party campaign financing is not addressed. This is a major part of the root causes of the country’s persistent fiscal and debt vulnerabilities, especially at state-owned enterprises.

*****

The writer is an Associate lecturer at the Aberdeen University

Latest Stories

-

Man remanded for uploading nude videos of a lady he lured into a relationship

3 hours -

Explainer: What is the Cash Waterfall Mechanism?

3 hours -

Survivors of child trafficking overcome adversity, excel in tertiary education

4 hours -

Confront the barriers to your progress – Professor Lydia Aziato challenges the youth

4 hours -

Expertise France leads EU-funded initiative empowering African Journalists to combat human trafficking

5 hours -

Ghana Grows Programme empowers Ghanaian youth through Youth Policy Dialogue

5 hours -

Eastern NDC raises GHS5.4m to support Mahama’s 2024 campaign

5 hours -

Kumawood actress Akyere Bruwaa condemns death rumours

5 hours -

Ghana Institution of Engineering calls for proactive measures to prevent flood disaster

5 hours -

Who pays for the extra cost? – COCOBOD CEO questions EU on new regulations

5 hours -

‘Dumsor’ will be over by end of May – Former NPP MP assures

6 hours -

Power crisis is not about money – NPP Manifesto Committee member

6 hours -

Education Minister urges graduates to embrace opportunities

6 hours -

UN rights chief ‘horrified’ by mass grave reports at Gaza hospitals

6 hours -

We need more resources to deal with flooding – NADMO

6 hours