Audio By Carbonatix

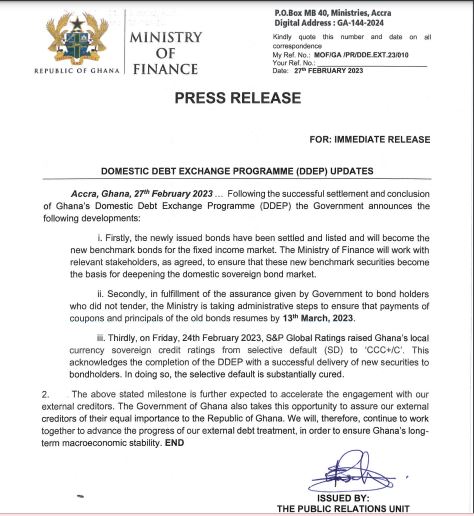

Finance Ministry says payment of coupons and principals in respect of the Domestic Debt Exchange Programme (DDEP) will start on March 13, 2023.

According to a release issued by the Ministry, this only applies to old bondholders who did not sign up for the DDEP.

“Secondly, in fulfillment of the assurance given by Government to bondholders who did not tender, the Ministry is taking administrative steps to ensure that payments of coupons and principals of the old bonds resume by 13th March, 2023,” part of the statement reads.

The assurance comes against the backdrop of three bondholder groups marching to the Finance Ministry on Monday to demand the immediate payment of coupons and principals which matured on February 6th and 20th February, 2023.

They are the Coalition of Individual Bondholders Groups made up of Pensioner Bondholders Forum, Individual Bondholders Association of Ghana and Individual Bondholders Forum.

The group gathered at the Finance Ministry on Monday, February 27, to check on the payment of coupons and principal for bondholders whose bonds had matured but whose payment had not been honoured despite government's promise.

Also, the Finance Minister, Ken Ofori-Atta promised that outstanding bonds which matured on February 6 for which government defaulted will be honoured after February 21.

“Settlements will be made after Tuesday, February 21 and then we can begin to look at processing everybody’s [bonds],” the Finance Minister assured the pensioner individual bondholders when they met to thank him for exempting them from the Debt Exchange Programme.

But in an interview with JoyNews’ Joseph Ackay Blay, the convener of the Pensioner Bondholders Forum, Dr. Adu Anane Antwi said the group wants to know what is causing the delay in payment.

According to him, the individual bondholders are worried.

“We are here to find out why coupons the Minister said will be paid on the 21st after the settlement day, we haven’t heard any information from the Ministry and therefore, we have come to find out why the payment has not been made yet,” he said.

Meanwhile, the release further noted that the newly issued bonds have been settled and listed and will become the new benchmark bonds for the fixed-income market.

The Ministry of Finance noted that it will work with “relevant stakeholders, as agreed, to ensure that these new benchmark securities become the basis for deepening the domestic sovereign bond market.”

Latest Stories

-

Learning to Stay Healthy in the New Year – Focus on the Basics

2 minutes -

Ghana aims to attain WHO Level Five preparedness under new health security plan

4 minutes -

African nations slam U.S. military strikes in Venezuela as threat to global sovereignty

14 minutes -

President Mahama’s First Year: Cautious reform or dangerous complacency?

20 minutes -

Prof. Bokpin calls on gov’t to apologise over NaCCA SHS teacher manual response

23 minutes -

UN Security Council weighs dangerous precedent set by US military operation in Venezuela

25 minutes -

Semenyo’s personality fits right with Man City team – Bernardo Silva

30 minutes -

One killed in road crash at Anyaa Market

34 minutes -

China announces record $1tn trade surplus despite Trump tariffs

38 minutes -

Global temperatures dipped in 2025 but more heat records on way, scientists warn

38 minutes -

Police arrest man over alleged sale of 3-year-old son for GH¢1m

42 minutes -

Asiedu Nketia calls for investigation into cocoa sack procurement under ex-government

46 minutes -

Ghanaians divided over DStv upgrades as government ramps up anti-piracy war

50 minutes -

African exporters face tariff shock as U.S. eyes AGOA Extension Bill

58 minutes -

Vanity, Power, Greed, and the People We Forgot to empower

1 hour