Fitch Solutions has maintained that Ghana will reach a staff-level agreement with the International Monetary Fund (IMF) by the first quarter of 2023.

This will mean that the country could secure a programme from the Fund by the end of quarter 1, 2023 or the second quarter of 2023.

Some economists and experts were anticipating that the country could reach a staff-level agreement with the Fund before the end of 2022 to pave way for a programme by the first quarter of 2023.

But in its latest paper on “Division within Ghana's Ruling Party to Weigh on Political Stability”, the international research firm also said should the Finance Minister, Ken Ofori-Atta, be replaced, negotiations with the IMF would likely remain largely unaffected.

“While Ofori-Atta remained opposed to an IMF bailout – we believe that he would take a more accommodative approach towards negotiations with the Fund. As such, we believe that a change of finance minister would most likely not impact the timeline of IMF negations and we would retain our view that a staff-level agreement will be reached in Q123 [quarter 1, 2023]”, it explained.

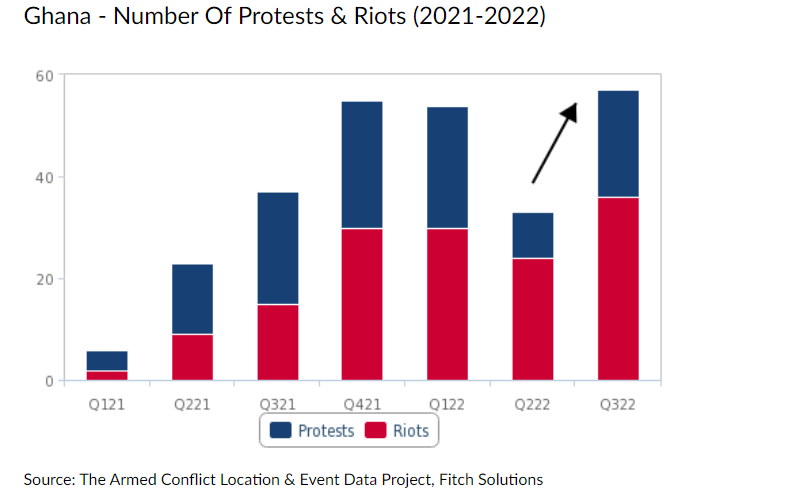

Government to face additional pressure from frequent protests

Furthermore, it said the government will face additional pressure from more frequent protests and industrial action.

“Worsening living standards amid rising consumer prices – inflation reached 40.4% year-on-year in October 2022, the highest reading since 2001 – and tighter monetary conditions have led to a 72.7% quarter-on-quarter increase in protests and riots across in quarter 3 2022. The country has also seen large industrial action in recent months, including a three-day retail strike in Accra in October [2022]".

Inflation to remain elevated, weighing on living standards

Fitch Solutions also expects inflation to remain elevated in the months ahead.

“Given that inflation is primarily driven by currency weakness, we expect price growth to remain elevated in the months ahead. Indeed, significant capital and financial account outflows caused by weakening investor sentiment will continue to weigh on the currency”.

“Our view is further informed by the fact that previous periods of significant exchange rate weakness in Ghana all lasted roughly 12-14 months, suggesting that the cedi will continue to depreciate into quarter 1, 2023 (the current sell-off started in January 2022). This will keep inflation high, weighing on living standards and eroding support for the government”.

Latest Stories

-

Ghana’s Antoine Semenyo fires Bournemouth to victory against Wolves

50 mins -

Everton 2-0 Liverpool: Everton apply final blow to Liverpool title challenge

59 mins -

Akufo-Addo nominates Felicia Attipoe as Tema West MCE

1 hour -

Today’s front pages: Thursday, April 25, 2024

1 hour -

We’ll not engage in opaque and obscure deals when elected – Prof Opoku-Agyemang

2 hours -

Energy and Finance Ministries must provide funding to fix energy challenges – IES

2 hours -

Reintroduce Fiscal Responsibility Act to tackle election budget overrun – Osafo Marfo

2 hours -

Prioritise transparency, avoid suppressing the truth – Opoku-Agyemang advises EC

2 hours -

In times of setbacks, I won’t say I was only the driver’s mate – Naana Jane assures Mahama

2 hours -

Joselyn Dumas opens up on why single mothers struggle to find partners

2 hours -

Three damaged ECG pylons result in power outage for 9 Shama communities

2 hours -

Dual citizens eligible for Chief Justice, Chief Director, other positions – Supreme Court rules

3 hours -

SIGA urges increased financial support for SOEs

3 hours -

Akufo-Addo vows to enhance Ghana’s power supply

3 hours -

19 steps for getting over even the most devastating breakup fast

6 hours