Despite projections that the policy rate of the Bank of Ghana will go down by the end of the first half of this year to ease cost of borrowing, it does not look so because of some perceived risks in the economy.

This is coming at a time that the Monetary Policy Committee begins its 100th quarterly meeting, from today 26th May, 2020 to review the state of the Ghanaian economy.

Prior to the end of the year, there were high expectations that the policy rate – the rate at which commercial banks borrow from the Bank of Ghana - will fall to lower the borrowing costs of household and business consumers.

Fitch Solutions and Moody’s Analytics have all projected about 1.0 percentage point drop in the policy rate by May this year. Their forecast were based on expected lower inflation and improve growth rate in the first quarter of this year.

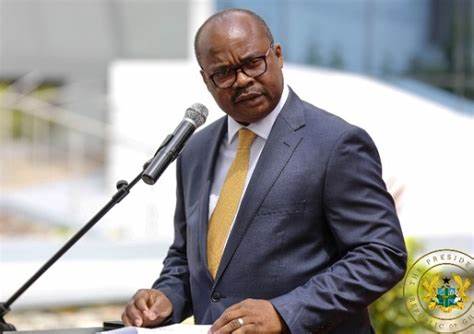

However, the large financing gap and debt which possess some threat to the economy could compel the MPC of the Bank of Ghana chaired by Governor Dr. Ernest Addison to maintain the policy rate at 14.5% for the 7th consecutive time since March last year.

Banking Consultant Dr. Richmond Atuahene told Joy Business that the policy rate will remain unchanged because of developments within the economy in the last couple of months, which does not support a reduction in the base lending rate.

“Looking at the various things that have happened over the last few months, including the announcement of taxes and taxes on fuel and others, and also looking at crude oil prices rising up to US$68 per barrel and other exigencies in the economy, I don’t think the policy rate can come down just in the near future. It has to stay there for some time.”

“And don’t forget that the policy rate level will also have something to do with interest rate, so we are in a dichotomy; we either keep the policy rate where it is and let the private sector not get access to cheap credit to expand the economy”, he further said.

The MPC will also assess the Bank of Ghana’s Composite Index of Economic Activity, the Business and Consumer Confidence indicator and make forecast for inflation and exchange rate, as well as proffer advise to the central government on measures to tackle the nation’s rising debt.

Latest Stories

-

Let’s prioritize research quality in higher education institutions for industrial growth-Prof. Nathaniel Boso

4 hours -

Herman Suede is set to release ‘How Dare You’ on April 24

8 hours -

Heal KATH: Kuapa Kokoo, Association of Garages donate 120k to support project

8 hours -

KNUST signs MOU with Valco Trust Fund, Bekwai Municipal Hospital to build student hostel

8 hours -

The influence Ronaldo has on people, Cadman Yamoah will have same on the next generation – Coach Goodwin

9 hours -

Gender Advocate Emelia Naa Ayeley Aryee Wins prestigious Merck Foundation Awards

10 hours -

South Africa bursary scandal suspects granted bail

10 hours -

Ecobank successfully repays $500m Eurobond due April 18

10 hours -

Re: Doe Adjaho, Torgbui Samlafo IV, call for Unity among Paramountcies in Anlo

10 hours -

Extortion and kidnap – a deadly journey across Mexico into the US

10 hours -

Rihanna says fashion has helped her personal ‘rediscovery’ after having children

10 hours -

Development Bank Ghana targets GH¢1bn funding for commercial banks in 2024

11 hours -

Shatta Movement apologises to Ghana Society of the Physically Disabled after backlash

11 hours -

Sammy Gyamfi writes: Tema-Mpakadan Railway Project; A railway line to nowhere

12 hours -

Bright Simons: Is the World Bank saving or harming Ghana?

12 hours