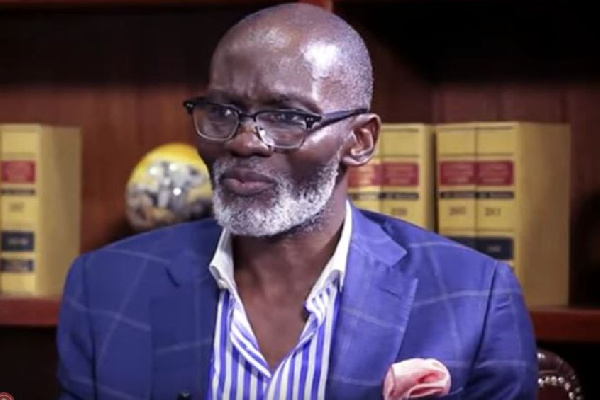

A leading member of the governing New Patriotic Party (NPP), Gabby Otchere-Darko, has raised concerns about the low publicity of government's austerity measures amidst the current economic challenges.

In a tweet on Saturday, he revealed that he has noted the calls from some sections of the populace, regarding the need for government to adjust its expenditure, in order to address the country's economic woes.

According to him, such measures have already been implemented, and therefore there's the need for the government's Public Relations machinery to work harder in bringing these interventions to the limelight.

"I am reading good suggestions on how to deal with the fiscal difficulties, like cutting down on govt expenditure. But, already spending is down by more than 20% and MDAs are feeling the pinch. The Presidency alone has cut expenditure down by over 30%. Govt must up its PR game!", he tweeted.

I am reading good suggestions on how to deal with the fiscal difficulties, like cutting down on govt expenditure. But, already spending is down by more than 20% and MDAs are feeling the pinch. The Presidency alone has cut expenditure down by over 30%. Govt must up its PR game!

— Gabby Otchere-Darko (@GabbyDarko) March 19, 2022

Meanwhile, government is expected to draw down the curtains on a crunch cabinet meeting today, Sunday March 20, which begun on Thursday, March 17.

The meeting, which is being chaired by President Akufo-Addo at the Peduase Lodge, is to fashion out effective measures to deal with the country's growing economic challenges.

Revealing the purpose of the meeting on Thursday, a JoyNews source stated that the meeting amongst other things, discussed the controversial E-levy Bill, and whether or not government should continue with its passage or resort to the International Monetary Fund (IMF).

Ghana’s current public debt stock stands at GH¢341.8 billion with a corresponding debt to GDP ratio of more than 77% as of September ending 2021.

This means if the country should share this amount across the country’s 30.8 million population, everyone will owe approximately GH¢11,000.

In terms of interest payments on our borrowings, Ghana has spent on average 147 billion Ghana cedis, which is 47 billion Ghana cedis more than our projected revenue plus grants for 2022.

In the first quarter of 2022, government has indicated that it will borrow a total of GH¢24.5 billion from the domestic market of which GH¢20.7 billion will be used to service existing debt in the local market, leaving government with just GH¢3.8 billion to finance other expenses.

Commenting on the country’s debt stock, the former Board Chairman of the Ghana Revenue Authority (GRA), Professor Adei, in an interview on Wednesday, proposed that the country’s expenditure be reduced.

“If you are exceeding your income, then you must accept to live below your income, which is the easy way, otherwise if you are earning GH¢3,000 and you are in debt of GH¢10,000 you cannot day to day spend GH¢3,000.

For you to get out of the rag you will have to cut your expenditure to GH¢2,000 because you must service your debt. So we are in that situation as a country,” he told Raymond Acquah on UpFront.

He explained that although cutting expenditure might be difficult for the government, especially nearing an election period, that is the right way to go.

“… And they [government] must thank God that this crisis has come now and not 2023, because if they don’t go for the hard one now, which normally will take about 18 months to go over this type of hunch, then they have a good chance by the middle of 2023 to see some good results in 2024.

If not, things would get worse and they want to prevent being thrown out of government, they would be thrown out anyway”, Prof Adei added.

Latest Stories

-

CAF Confederation Cup: Dreams face Zamalek, RS Berkane take on holders, USM Algiers

1 hour -

PURC could have found a better approach to settle issues with ECG – Dr Manteaw

2 hours -

CAFCC: John Antwi sure of positive result against Zamalek

2 hours -

I’ll choose Osofo Kyiri Abosom as my running mate over Akua Donkor – Prophet Kumchacha

2 hours -

LPG prices surge in Ghana, raising concerns over tax impact

2 hours -

I commend PURC for taking courageous step to fine ECG board members – Kwame Pianim

3 hours -

Financing assurance secured from bilateral creditors to aid 2nd review funding for Ghana – IMF Africa head

3 hours -

Man who set himself on fire outside Trump’s Manhattan hush money trial dies

3 hours -

Fuel purchase issues have nothing to do with personal interest – Egypa Mercer

3 hours -

ISRQ2024: Theorose School wins Championship with 0.5 points, heads to Canada

4 hours -

Use your voice, talents, skills to advocate for positive change – UniMAC VC tells graduates

4 hours -

Livestream: Newsfile discusses ‘dumsor’, Ex-MASLOC CEO jail and Election 2024

4 hours -

Otumfuo STEM Festival launched to find problem-solvers, promote science education

4 hours -

Irene Logan ties the knot in colourful ceremony

4 hours -

Alliance with other parties, not a merger – Alan Kyerematen

5 hours