Ghana’s Finance Minister says it will take sacrifice and “burden-sharing as a people with one language” to transform the country’s economy.

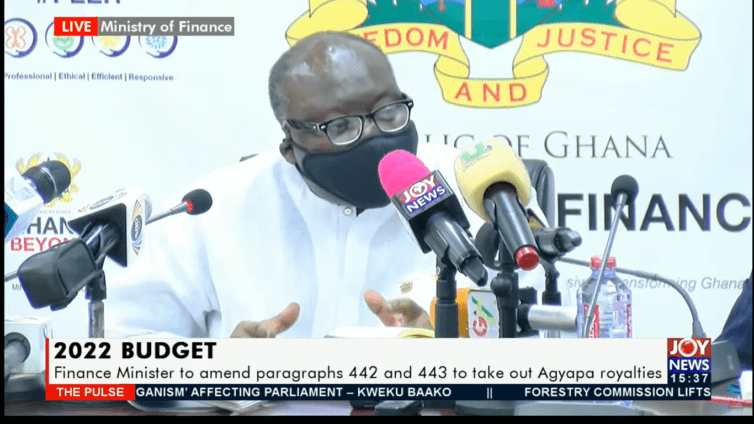

Ken Ofori-Atta who was speaking at a press briefing to, among others, court support for the recently introduced electronic transaction levy, popularly known as e-levy, said the initiative will help to widen the country’s tax base and generate revenue.

According to him, “out of about 18 million potential income taxpayers, only 2.4million persons, approximately 8% of the total population, are registered as personal income taxpayers as of August, 2021", hence the need to widen the tax base so as to be able to service the country’s debt and curb unemployment.

“Only 45,109 entities are registered as corporate taxpayers while 54,364 persons are registered as self-employed taxpayers at the Ghana Revenue Authority; and there are about 17 million registered voters and about 19 million active mobile money accounts.

“In using the 17 million registered voters or the 19 million mobile money accounts as a proxy for Ghanaians that are of adult age and economically active, and comparing it to the 2.4 million Ghanaians who pay income tax, we are confronted with the stark reality that the structure of our economy is quite informal, unlike the western economies, and as such, the traditional tax handles, like the personal income tax, also known as PAYE, may not be as effective in raising the required revenue” the Finance Minister explained.

Again, Mr. Ofori-Atta stressed that Ghana’s GDP of 12.2% is lower than other African countries and must therefore be addressed. He emphasized that the development is a poor reflection on the country and called for a change in the narrative.

"As I mentioned in my Budget Speech, recent economic data suggests that the overall tax to GDP ratio for SSA in 2018 was 16.5%. The tax to GDP ratio for Ghana in 2019 was estimated to be 12.2%. Our tax-to-GDP ratio is lower than our peer countries in West Africa and significantly lower than many developed nations. (South Africa - 26.7%, Senegal - 16.4%, SSA average-16.5%, Ghana-12.2% in 2019).

"These statistics are a poor reflection on the country and highlight the need to change the narrative."

Government introduces Electronic Transaction Levy

Government has decided to place a levy on all electronic transactions to widen the tax net and rope in the informal sector.

The Electronic Transaction Levy or E-Levy covers electronic transactions, including mobile money payments, bank transfers, merchant payments and inward remittances.

1.75% to be charged will be borne by the sender except inward remittances, which will be borne by the recipient.

According to the Finance Minister, to safeguard efforts being made to enhance financial inclusion and protect the vulnerable, “all transactions that add up to ¢100 or less per day (which is approximately ¢3000 per month) will be exempted from this levy.”

The levy, which is supposed to take effect January next year, will be used to support entrepreneurship, youth employment, cyber security, digital and road infrastructure among others.

But this initiative has been widely criticised for being insensitive to the plights of Ghanaians amidst the Covid-19 pandemic and its impact.

Latest Stories

-

Let’s prioritize research quality in higher education institutions for industrial growth-Prof. Nathaniel Boso

4 hours -

Herman Suede is set to release ‘How Dare You’ on April 24

7 hours -

Heal KATH: Kuapa Kokoo, Association of Garages donate 120k to support project

8 hours -

KNUST signs MOU with Valco Trust Fund, Bekwai Municipal Hospital to build student hostel

8 hours -

The influence Ronaldo has on people, Cadman Yamoah will have same on the next generation – Coach Goodwin

8 hours -

Gender Advocate Emelia Naa Ayeley Aryee Wins prestigious Merck Foundation Awards

9 hours -

South Africa bursary scandal suspects granted bail

10 hours -

Ecobank successfully repays $500m Eurobond due April 18

10 hours -

Re: Doe Adjaho, Torgbui Samlafo IV, call for Unity among Paramountcies in Anlo

10 hours -

Extortion and kidnap – a deadly journey across Mexico into the US

10 hours -

Rihanna says fashion has helped her personal ‘rediscovery’ after having children

10 hours -

Development Bank Ghana targets GH¢1bn funding for commercial banks in 2024

11 hours -

Shatta Movement apologises to Ghana Society of the Physically Disabled after backlash

11 hours -

Sammy Gyamfi writes: Tema-Mpakadan Railway Project; A railway line to nowhere

12 hours -

Bright Simons: Is the World Bank saving or harming Ghana?

12 hours