Finance Minister, Ken Ofori-Atta, has expressed confidence that government would reach a Staff-Level Agreement with the International Monetary Fund soon for a programme aimed at restoring macroeconomic stability and protecting the most vulnerable.

To this end, it is determined to implement a wide-ranging structural and fiscal reforms to restore fiscal and debt sustainability and support growth.

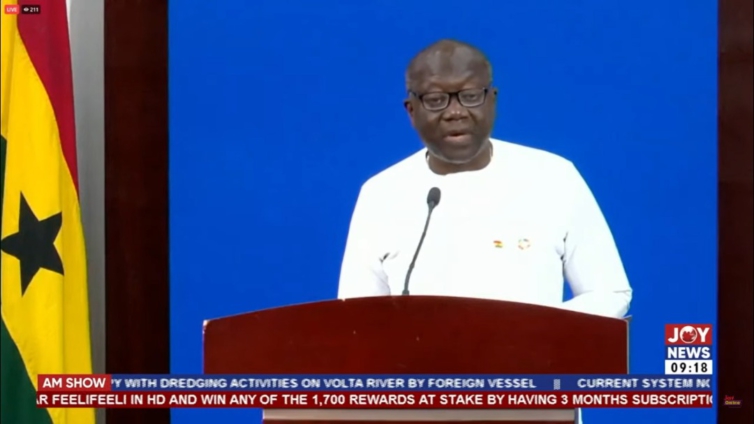

Speaking at the launch of the Debt Exchange Programme, Mr. Ofori Atta said the objective of the programme is to alleviate the debt burden in a most transparent, efficient, and expedited manner.

“In this context, by means of an exchange offer, the Government of Ghana has been working hard to minimize the impact of the domestic debt exchange on investors holding government

bonds”.

The Finance Minister noted that the domestic debt exchange is part of a more comprehensive agenda to restore debt and financial sustainability, adding “we are also working towards a restructuring of our external indebtedness, which we will announce in due course”.

“This is a key requirement to allow Ghana’s economy to recover as fast as possible from this crisis. This is also a key requirement to secure an IMF support”, he explained.

Mr. Ofori-Atta also expressed optimism that the measures put in place, including those outlined in the 2023 Budget Statement and underpinned by a successful IM programme will witness a stable and thriving economy for Ghana from 2023.

Accordingly, he said there is an anticipation that inflation will be returned to single digit, ensuring that real returns on these new bonds will be protected.

The domestic debt operation involves an exchange for new Ghana bonds with a coupon that steps up to 10% as soon as 2025 (with a first interest payment in 2024) and longer average maturity.

Existing domestic bonds as of December 1, 2022, will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037.

The predetermined allocation ratio includes 17% for short bonds, 17% for the intermediate bond, 25% for the medium-term bond and 41% for the long-term bond.

The annual coupon on all of these new bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity. Coupon payments will be semi- annual.

Latest Stories

-

Let’s prioritize research quality in higher education institutions for industrial growth-Prof. Nathaniel Boso

4 hours -

Herman Suede is set to release ‘How Dare You’ on April 24

8 hours -

Heal KATH: Kuapa Kokoo, Association of Garages donate 120k to support project

8 hours -

KNUST signs MOU with Valco Trust Fund, Bekwai Municipal Hospital to build student hostel

8 hours -

The influence Ronaldo has on people, Cadman Yamoah will have same on the next generation – Coach Goodwin

9 hours -

Gender Advocate Emelia Naa Ayeley Aryee Wins prestigious Merck Foundation Awards

10 hours -

South Africa bursary scandal suspects granted bail

11 hours -

Ecobank successfully repays $500m Eurobond due April 18

11 hours -

Re: Doe Adjaho, Torgbui Samlafo IV, call for Unity among Paramountcies in Anlo

11 hours -

Extortion and kidnap – a deadly journey across Mexico into the US

11 hours -

Rihanna says fashion has helped her personal ‘rediscovery’ after having children

11 hours -

Development Bank Ghana targets GH¢1bn funding for commercial banks in 2024

11 hours -

Shatta Movement apologises to Ghana Society of the Physically Disabled after backlash

12 hours -

Sammy Gyamfi writes: Tema-Mpakadan Railway Project; A railway line to nowhere

12 hours -

Bright Simons: Is the World Bank saving or harming Ghana?

13 hours