Audio By Carbonatix

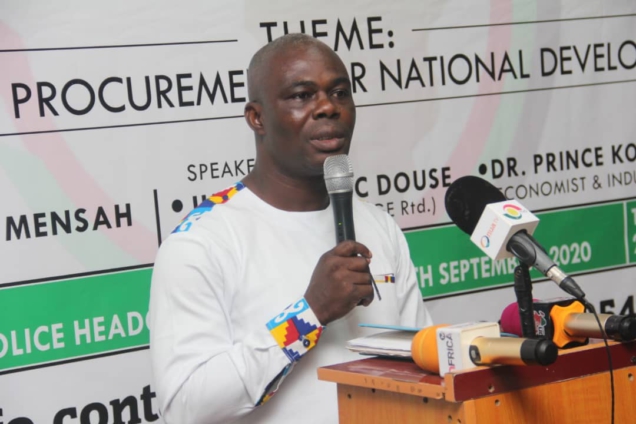

Economist and Lecturer, Wisconsin International University College, Rev Dr Samuel Worlanyo Mensah, has called on Parliament to investigate the Bank of Ghana's GH¢60.8 billion loss.

He said although the Central Bank had attributed the loss to the domestic debt restructuring programme in its 2022 annual report, there ought to be a Parliament committee to probe whether or not there had been some irregularities and illegalities.

"Is it not frightening that the Bank of Ghana would superintend over this huge loss? I believe there were irregularities and illegalities and a Parliamentary committee must investigate the GH¢60.8 billion loss and any wrongdoing found must be punished,” Dr Mensah said.

https://myjoyonline.com/https-myjoyonline-com-bog-records-60-8bn-loss-in-2022/

He said the investigation should include other statutory transactions that the Bank had undertaken in the past eight to 10 years.

The Bank of Ghana explained the reason for the loss as the impairment of the holdings of marketable government stocks and non-marketable instruments of government being held in their books.

It said the stocks of government instruments had built over the years, adding that the holdings of the instruments and COCOBOD exposures were all part of the debt exchange where the Bank of Ghana served as the loss absorber to the entire debt exchange programme.

This resulted in the Central Bank taking on 50 per cent principal haircut on the total principal which stood at GH¢ 64.5 billion at the time of the exchange.

Speaking in an interview with the Ghana News Agency, Worlanyo Mensah said the government didn't spend much on those transactions and for that matter, the programme should not be an expenditure attributed to the transactions of Bank of Ghana.

He said the rationale used for revoking the licenses of some financial institutions during banking sector cleanup should be the same rationale in investigating the Central Bank for any irregularities.

"As a crucial regulator and a huge industry player, you can't do things haphazardly. The Bank of Ghana had not given the breakdown of how it incurred the loss, raising a concern for interrogation," the Lecturer said.

He said if the details had been provided and cost-benefit analysis and investigation had proven that the Bank was complicit, then those who oversaw activities leading to the loss should be charged for mismanagement, misappropriation and misapplication of public funds.

Dr Mensah said Ghanaian had been going through a serious socioeconomic turmoill and the loss of such a colossal amount of money (Gh¢ 60.8 billion) which is equivalent to about $5.4 billion, more than the $3 billion IMF bailout be "swept under the carpet."

"The Gh¢ 60.8 billion could be used to champion the industrialisation drive, that is the One District One Factory. The money could build all the factories for us in all the districts across the country," he added.

Latest Stories

-

Kingsford Boakye-Yiadom nets first league goal for Everton U21 in Premier League 2

15 minutes -

We Condemn Publicly. We Download Privately — A Ghanaian Digital Dilemma

2 hours -

Renaming KIA to Accra International Airport key to reviving national airline – Transport Minister

3 hours -

Interior Minister urges public not to share images of Burkina Faso attack victims

3 hours -

Unknown persons desecrate graves at Asante Mampong cemetery

3 hours -

I will tour cocoa-growing areas to explain new price – Eric Opoku

3 hours -

Ghana to host high-level national consultative on use of explosive weapons in populated areas

3 hours -

Daily Insight for CEOs: Leadership Communication and Alignment

4 hours -

Ace Ankomah writes: Let’s coffee our cocoa: My Sunday morning musings

4 hours -

Real income of cocoa farmers has improved – Agriculture Minister

4 hours -

I’ll tour cocoa-growing areas to explain new price – Eric Opoku

4 hours -

Titao attack should be wake-up call for Ghana’s security architecture – Samuel Jinapor

4 hours -

New Juaben South MP Okyere Baafi condemns Burkina Faso attack, demands probe into government response

4 hours -

A/R: Unknown assailants desecrate graves at Asante Mampong cemetery

4 hours -

What is wrong with us: Africans know mining, but do not understand the business and consequences of mining

5 hours