Audio By Carbonatix

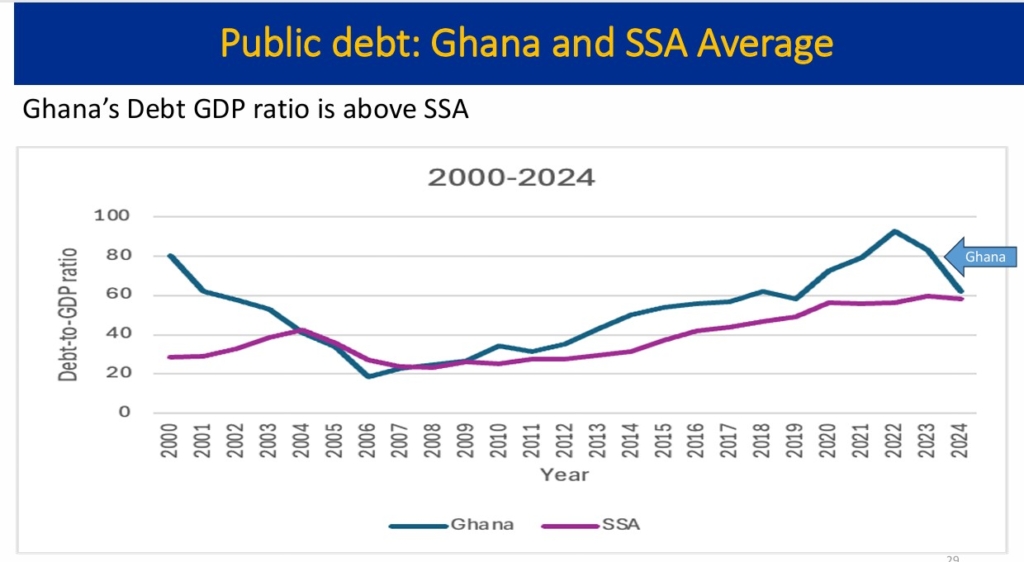

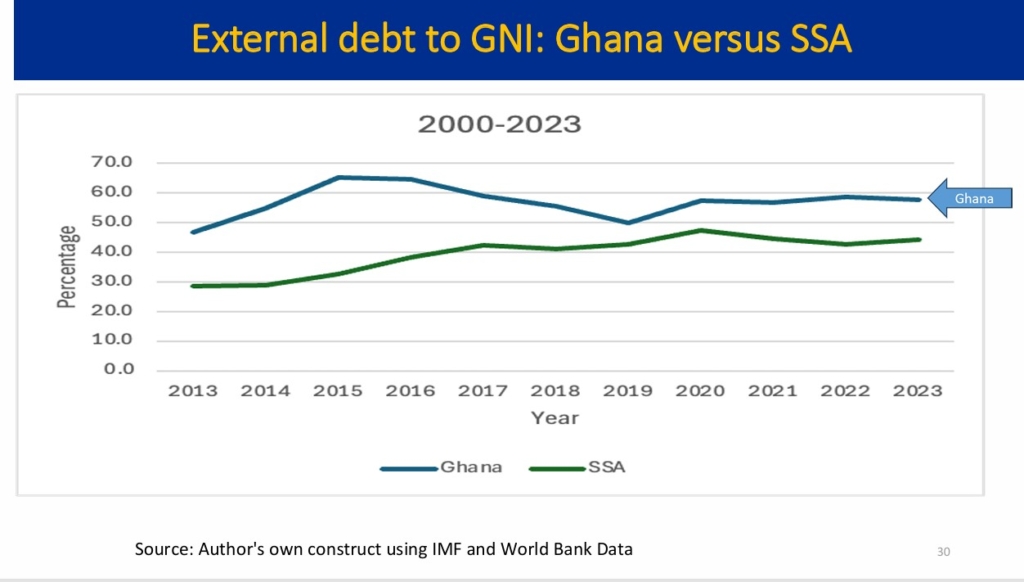

Ghana’s debt burden has risen significantly over the past decade, reaching 82.9% of GDP in 2023 before declining to 61.8% by the end of 2024.

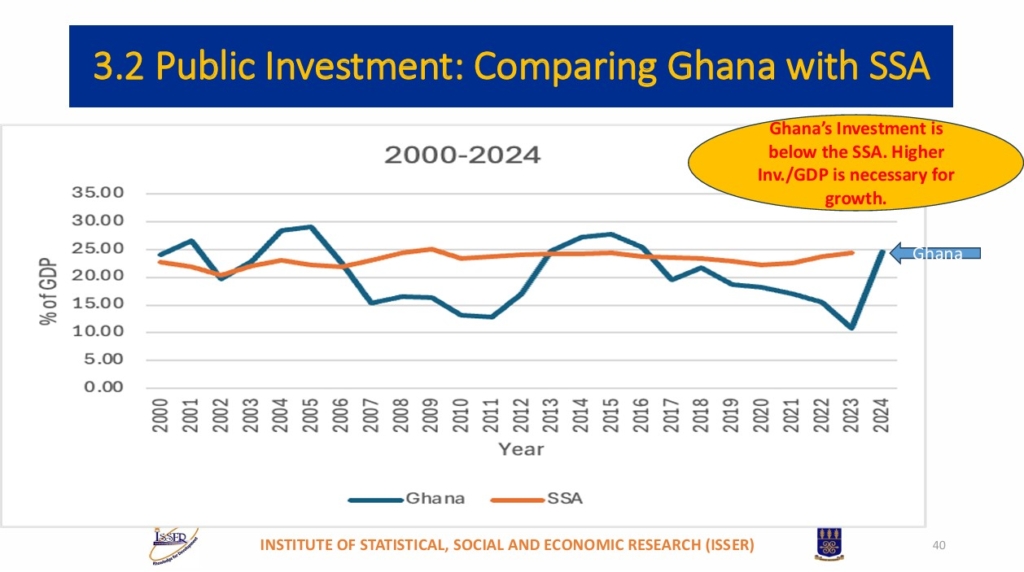

Despite this heavy borrowing, the country has not seen a proportional increase in investment, raising concerns about whether loans have been used productively or merely to finance recurrent expenditures.

At his Inaugural Lecture on March 13, 2025 at the Ghana Academy of Arts and Sciences, Professor Peter Quartey, Director of the Institute of Statistical, Social and Economic Research (ISSER), examined the link between debt, investment, and economic growth in Ghana.

He argued that while borrowing is a necessary tool for development, its effectiveness depends on strategic investment decisions.

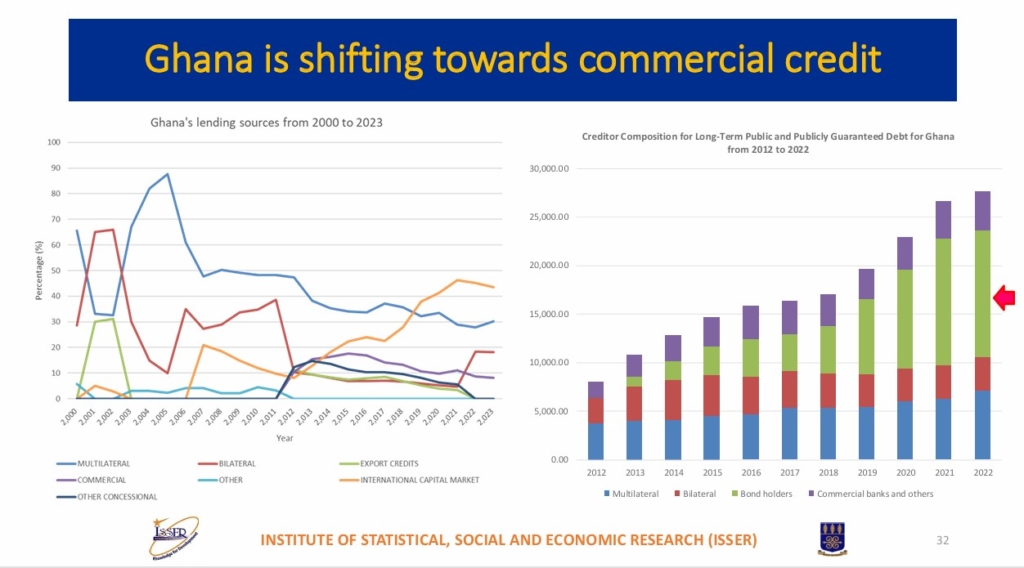

Over the years, Ghana has shifted from multilateral lending to high-interest bonds on the international capital markets.

This transition, according to Professor Quartey, has made debt servicing more expensive and constrained the country’s ability to invest in productive sectors.

Capital spending in Ghana has dwindled from 6.9% of GDP in 2010 to just 2.4% in 2023, indicating that much of the borrowed funds have not been directed toward infrastructure or other forms of investment for economic expansion.

Case studies he presented during the lecture highlighted the importance of investment efficiency. One example compared a financially reckless technology entrepreneur to Ronald Read, a frugal janitor-turned-investor who amassed millions through disciplined savings.

Professor Quartey used these examples to stress that financial success is not solely about acquiring resources but about managing them effectively.

He pointed out that in Ghana, several high-profile projects financed through loans, such as the Sinohydro and Afreximbank-funded initiatives, have faced significant delays.

He said the Pwalugu Multi-Purpose Dam project, expected to enhance electricity generation and irrigation, has yet to commence six years after funding was disbursed.

Such inefficiencies, he warned, undermined the potential benefits of debt-driven investments.

Professor Quartey recommended stronger fiscal discipline, a legislated debt ceiling of 60% of GDP, and enhanced domestic revenue mobilisation to reduce reliance on borrowing.

He also called for improved procurement practices to ensure better value for money and to curb wasteful spending.

With Ghana’s debt now exceeding GHȼ721 billion, he pointed out that it will be difficult to defend the position that the country has strategically invested for sustainable growth or that borrowing has indeed served as a catalyst for the nation’s development.

Latest Stories

-

Ghana Water targets the end of January 2026 to resolve Teshie water crises

3 hours -

All UG students who overpaid fees will be refunded – Deputy Education Minister

4 hours -

Majeed Ashimeru set for La Louvière loan switch from Anderlecht

4 hours -

NPP flagbearer race: Any coercion in primaries will be resisted – Bryan Acheampong campaign team

4 hours -

‘Infection spread’ feared: Teshie water crisis triggers healthcare emergency

4 hours -

AratheJay turns ‘Nimo Live’ into defining homecoming moment

5 hours -

NPP race: No official complaint over N/R allegations – Haruna Mohammed

6 hours -

Security analyst warns protocol recruitment eradication will not happen overnight

6 hours -

KGL Foundation commissions ultra-modern Gloria Boatema Dadey-Nifa Basic School at Adukrom

6 hours -

GIMPA reveals GH¢1.7m debt from defaulting sponsored lecturers

6 hours -

PAC cites five GIMPA lecturers for GH¢1.7m bond default

7 hours -

Google confirms that it won’t get Apple user data in new Siri deal

7 hours -

Gomoa Central Special Economic Zone to become first major industrial hub in Central Region – Vice President

7 hours -

Carlos Alberto Pintinho: The ex-Sevilla star who can never play football again

7 hours -

UBA Ghana names Bernard Gyebi Managing Director as bank reorganises top leadership

7 hours