“There is no fundamental exercise better for the heart than reaching down and lifting people up the essence of our existence”. This is a heartfelt appreciation of the millions of people reaching out to the Ukrainian refugees and showing them that the creator still lives and will meet them at the point of their needs either in death or alive.

The major supply chain disruption that results from this turmoil has the potential to spark something far more significant than the Cold War, with an Iron Curtain isolating the West from Russia.

Global supply lines established by Western firms after the fall of the Berlin Wall more than three decades ago could be severely disrupted.

In this way, the COVID-19 pandemic exacerbated the already-disordered state of supply chains, which are frequently large networks of resources, money, information, and people that businesses rely on to distribute goods or services to consumers, resulting in major shortages, disruptions, and price inflation.

In addition, the aggravation of this, as well as the consequent sanctions against Russia, will put more strain on them, with resultant consequences including increasing energy prices and worries of famine.

In every argument on the world stage, this famine is well-represented, and developing economies are well-versed in it.

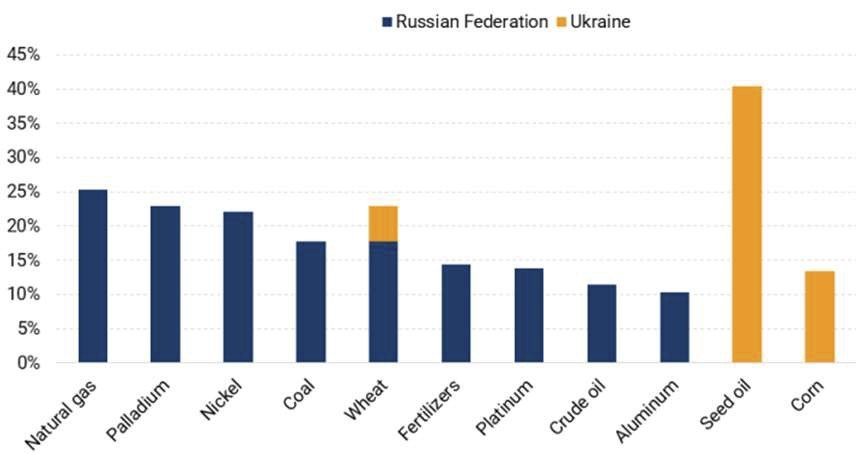

Fuel and rising food costs are the most prominent immediate consequences. Russia produces almost 40 % of Europe’s natural gas and 65 % of Germany’s natural gas, according to the International Energy Agency (IEA).

Russia is the world’s third-largest oil exporter and accounts for 7 % of all crude oil and petroleum product imports into the United States, according to the International Energy Agency. It is worth noting that Russia is regarded as the world’s leading exporter of wheat.

They together with Ukraine account for around 29 percent of the worldwide wheat export market. In addition, Ukraine surpassed the United States as the world’s leading supplier of corn, barley, and rye by 2021 (CNBC Report, 2022). Due to the turmoil, all of these activities have come to a standstill. So, food inflation is on the horizon, with the impact being felt most acutely in developing countries.

Furthermore, the unrest may continue to put pressure on metal markets. Russia has around 10 % of the world’s copper reserves and is also a major producer of nickel and platinum. Nickel has been trading at an 11-year high, and any disruption in supply caused by the war is likely to result in further price hikes for aluminum (interos.com).

According to the Financial Times (FT), Ukraine account for 25 percent of global neon supply in 2022, while Russia plays a big role in major EU imports as well as a supplier to the EU market.

Consequently, the EU imports 9 percent of primary aluminum, 42 percent of semi-finished steel, 42 percent of palladium supply (85 percent of palladium produced is used for automotive catalysts), 12 percent of platinum supply (39 percent of platinum produced is used for automotive catalysts), 9 percent of rhodium supply (91 percent of rhodium produced is used for automotive catalysts), and 11.2 percent of the world’s nickel production, which is used in vehicle batteries.

Russian sanctions ad spillover effects on world commerce, with the most vulnerable economies in Africa bearing the brunt of the impact.

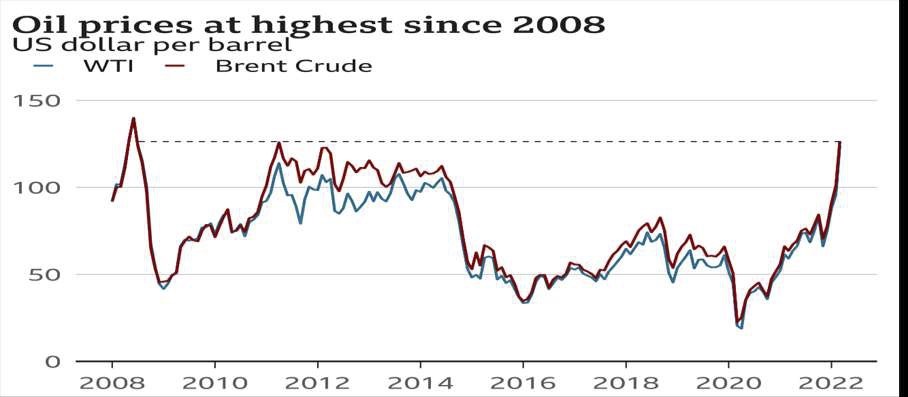

Crude oil prices soared to $115 per barrel after members of the International Energy Agency decided to release 60 million barrels of oil from emergency stocks, according to Bloomberg. This volatility was sparked by the sanctioning of Russia, which is a significant energy producer and exporter, as well as the retaliatory closure of major supply routes (Fig 1).

Implications for Food Security in Developing Countries

The world has reached a point where economies are increasingly inward-looking, with the primary focus on their local economies and welfare issues before turning their attention to the developing world. This was most noticeable and dramatic during the COVID-19 vaccine procurement and rationing, where affluent economies procured millions of doses at the cost of weaker or poorer economies. Sub-Saharan Africa was on the receiving end of the pandemic, and the lack of vaccines had a significant impact on their coping strategies.

The fundamental point is that developing economies, particularly in sub-Saharan Africa, must innovate in order for them to be competitive. This includes sourcing sufficient alternatives to wheat, increasing local content in the areas of technology, and developing sustainable industrial platforms as an ecosystem where the youth can practice finding solutions to our problems.

The governments should deliberately establish agricultural policies that allow citizens to eat-what-they-grow, as part of a purposeful policy. Local food production using organic fertilisers, technological advancements, and substantial capital investment in renewable energy sources such as solar and biogas must be given top priority. These will lessen our reliance on foreign goods and position us as net exporters.

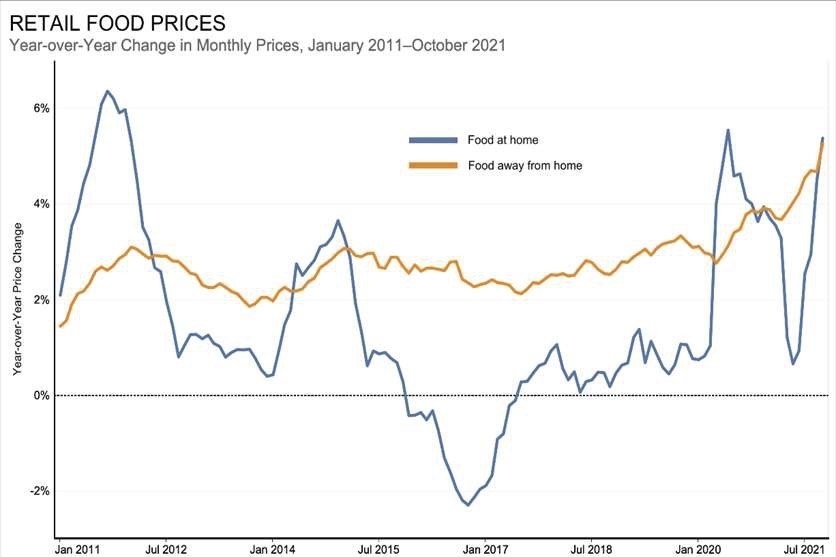

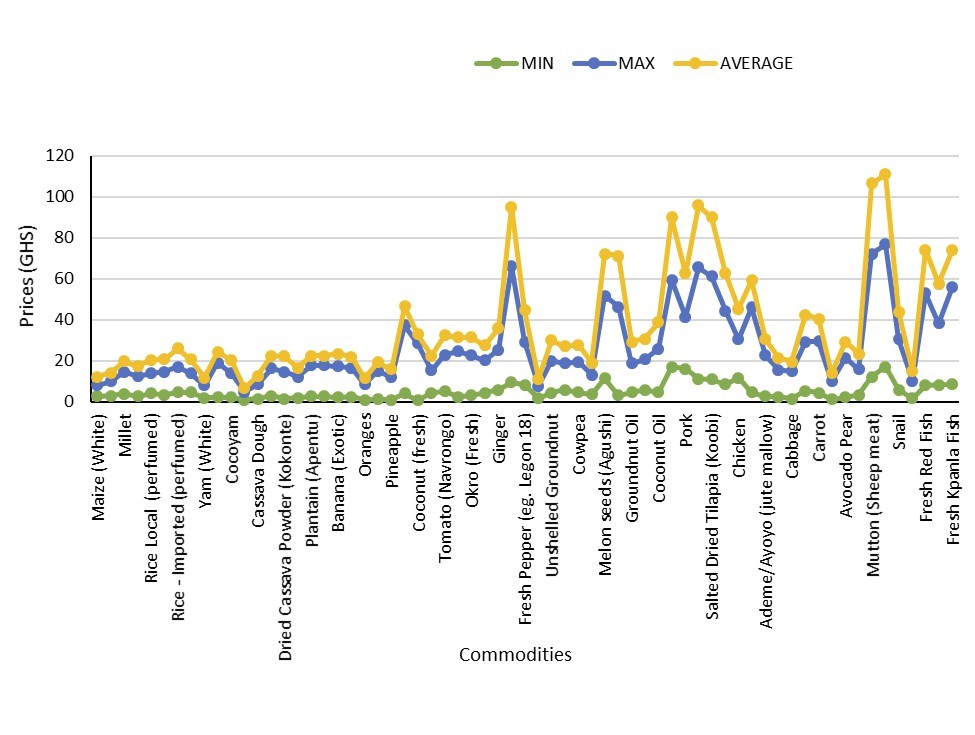

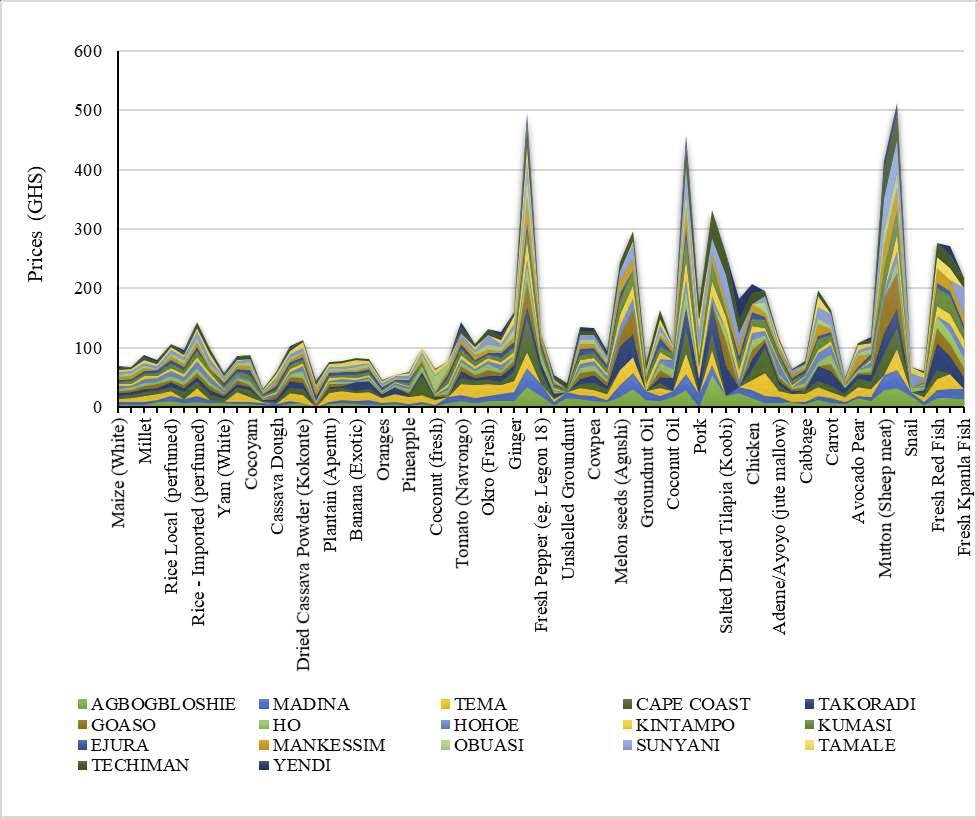

In order to transform important agricultural exports such as cocoa, rubber, coffee, and lumber into semi-finished or finished industrial goods, there needs to be wider stakeholder participation involving all African technocrats and governments (Fig 2-3). When it comes to increasing the value of our exports while also offering sufficient work possibilities for the teeming youth, this will be a game-changer.

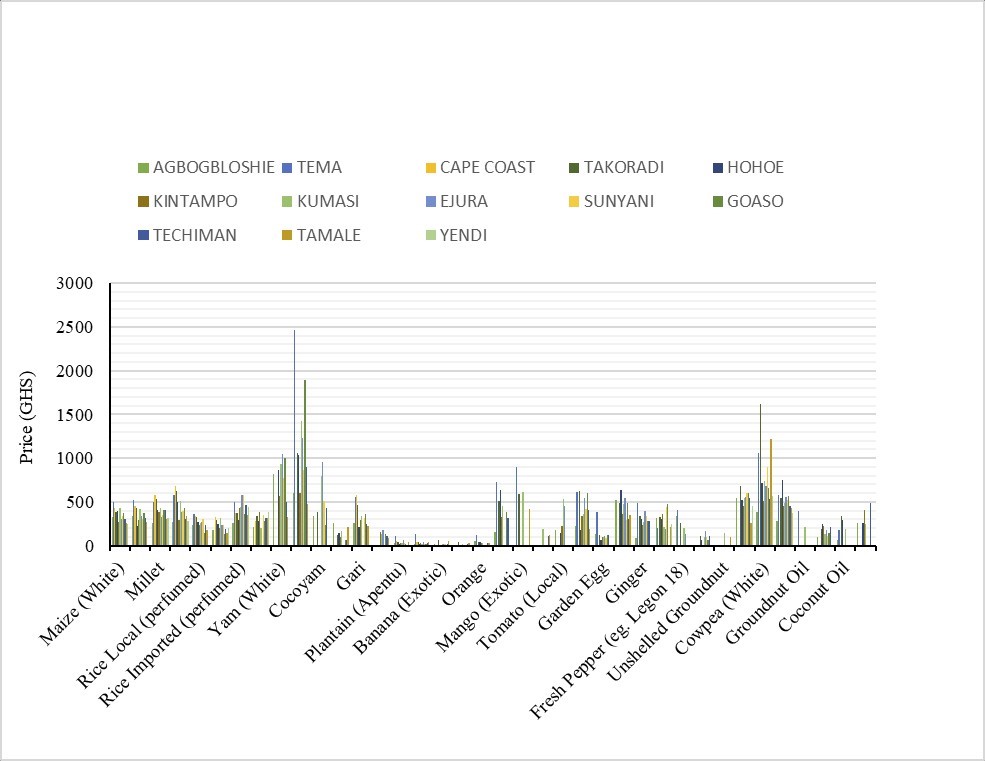

Food inflation in Ghana has been on the rise in recent months. Thus, price volatility, along with a weakening cedi and the effects of fuel price increases, are the main drivers exposing the Ghanaian economy’s hard times.

Furthermore, supply constraints from big producers and importers alike cast a bleak picture of Ghana’s economy, with serious consequences for food security and sustainable value chains. The poor and marginalised in urban suburbs and rural poor will be the hardest hurt.

As a result, urgent fiscal adjustments and pragmatic actions to ensure cedi stability, consistent and steady inflation trends, and fuel price stability are required.

In order to develop a national mindset about home-grown solutions and an attitude of working to develop our economies, citizens across developing economies should be conscientious, and institutions should be strengthened to inculcate a development mindset in citizens, particularly among youth, who are the future leaders of our countries. Everything that a people may accomplish requires purposeful efforts, work ethics that are anchored in change, and structures based on consensus and collaborative involvement.

Latest Stories

-

Man remanded for uploading nude videos of a lady he lured into a relationship

4 hours -

Explainer: What is the Cash Waterfall Mechanism?

4 hours -

Survivors of child trafficking overcome adversity, excel in tertiary education

5 hours -

Confront the barriers to your progress – Professor Lydia Aziato challenges the youth

5 hours -

Expertise France leads EU-funded initiative empowering African Journalists to combat human trafficking

5 hours -

Ghana Grows Programme empowers Ghanaian youth through Youth Policy Dialogue

5 hours -

Eastern NDC raises GHS5.4m to support Mahama’s 2024 campaign

5 hours -

Kumawood actress Akyere Bruwaa condemns death rumours

6 hours -

Ghana Institution of Engineering calls for proactive measures to prevent flood disaster

6 hours -

Who pays for the extra cost? – COCOBOD CEO questions EU on new regulations

6 hours -

‘Dumsor’ will be over by end of May – Former NPP MP assures

6 hours -

Power crisis is not about money – NPP Manifesto Committee member

6 hours -

Education Minister urges graduates to embrace opportunities

6 hours -

UN rights chief ‘horrified’ by mass grave reports at Gaza hospitals

7 hours -

We need more resources to deal with flooding – NADMO

7 hours